Navigating the world of home financing can be daunting, especially with the myriad of mortgage options available.

Two of the most popular choices for homebuyers are FHA loans and conventional loans, each with its own set of benefits and considerations.

But how do you determine which type of mortgage is right for you?

In this blog post, we’ll break down the key differences between FHA loans and conventional loans.

We’ll explore their unique advantages and potential drawbacks, and help you make an informed decision that aligns with your financial goals and homeownership dreams.

Whether you’re a first-time homebuyer or looking to refinance, understanding these mortgage options is crucial for securing the best deal and ensuring a smooth journey to your new home.

What is an FHA Loan?

An FHA loan is supported by the Federal Housing Administration to shield the lender in case the borrower fails to pay back the loan. This type of loan necessitates a minimum credit score of 500.

Additionally, it mandates mortgage insurance premiums (MIPs), regardless of one’s credit score or the amount put down for the down payment. Essentially, FHA loans aid individuals who might not otherwise meet the requirements to obtain financing for a home purchase.

What is a Conventional Loan?

A conventional loan refers to any mortgage not supported by a government agency such as the FHA, U.S. Department of Agriculture (USDA), or U.S. Department of Veterans Affairs (VA). Generally, conventional loans adhere to guidelines set by federal regulators, although this is not mandatory.

Fannie Mae and Freddie Mac exclusively buy loans that meet these criteria, yet some lenders prioritize meeting the needs of specific borrowers over conforming to secondary market requirements. These loans can help finance a primary residence, second home, or rental property, and are available through banks, credit unions, or private lenders.

In comparing FHA and conventional loans, we will focus on conventional loans that do follow Fannie Mae and Freddie Mac’s regulations, a.k.a. ‘conforming loans.’

What are the Differences Between FHA vs. Conventional Loans?

When you’re faced with the decision of whether to go with a FHA loan or a conventional mortgage, it can often feel like a tough choice. Even though some of the requirements for FHA loans may overlap with conventional loans, there are key differences that set them apart from each other.

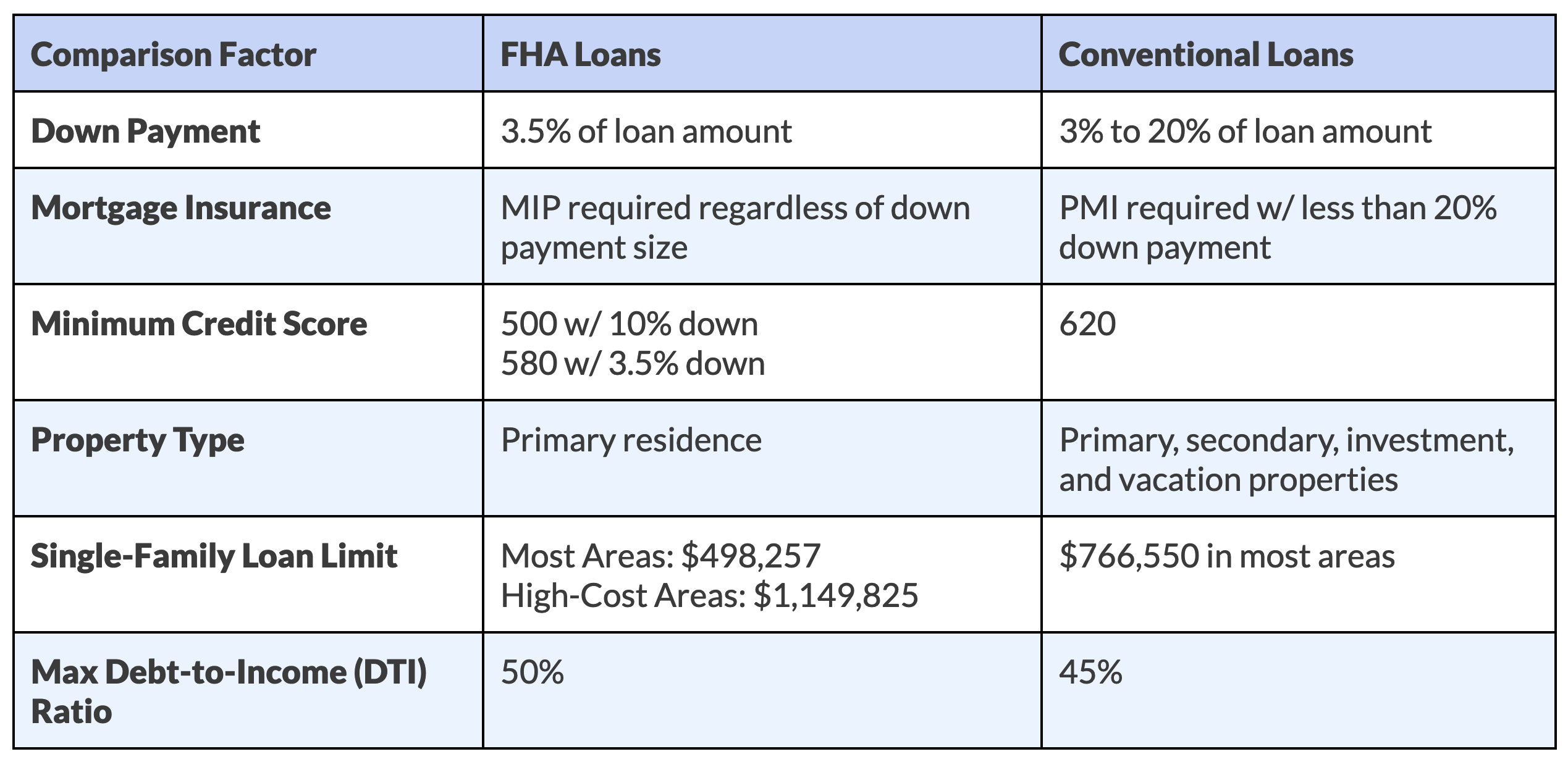

To help you understand the differences better, take a look at the table provided below. It highlights the essential factors you should consider when comparing FHA loans and conventional loans.

Let’s explore the specifics of several factors and understand situations when one loan type might be more favorable than the other.

Down Payment

If you’re having trouble saving for a down payment, consider a VA loan. Yet, conventional loans often ask for lower down payments than you might think.

FHA Loans

The down payment requirement of an FHA loan depends largely on your credit score. If your score falls between 500 and 579, you’ll need to fork out a minimum down payment of 10%.

Conversely, if your credit score hits 580 or above, you’re good with just a 3.5% down payment. Keep in mind that FHA guidelines permit you to utilize gifted funds for your down payment.

Conventional Loans

To get a conventional loan, you usually need at least a 3% down payment. Lenders that offer conventional loans typically prefer larger down payments. The minimum may be 3%, but they recommend 20% or larger.

By doing so, you avoid paying mortgage insurance. Some programs might allow for a 0% down payment if you qualify as a low-income earner or first-time homebuyer.

Mortgage Insurance (PMI)

Mortgage insurance helps lenders in case you can’t make payments and fail to repay your loan. FHA loan insurance is usually pricier than conventional insurance since FHA lenders approve loans for borrowers with lower credit scores, posing higher risks. Yet, if you boast a high credit score, you might pay less for conventional insurance.

FHA Loans

FHA loans require two types of mortgage insurance premiums: upfront and annual. The upfront mortgage insurance premium (UFMIP) is 1.75% of the loan amount and is usually added to the loan balance.

The annual mortgage insurance premium (MIP) is split into 12 parts and included in your monthly payment. This cost typically varies from 0.15% to 0.75%, depending on your loan amount and term.

Regardless of your down payment, you must pay FHA mortgage insurance, which cannot be circumvented by a larger down payment. Your credit score doesn’t impact the amount of mortgage insurance you pay; instead, the loan amount and down payment determine how long you will make these payments.

Conventional Loans

Private mortgage insurance (PMI) is necessary for conventional mortgages when your down payment is less than 20%. Annual PMI costs vary from 0.15% to 1.95% of your loan amount, based on your credit score and down payment.

Plan to spend approximately $30 to $70 per month for every $100,000 you borrow. You can stop paying for PMI once you demonstrate 20% equity in your home.

Credit Score

Your credit score plays an important role in your eligibility, borrowing capacity, and interest rate.

Lenders check your credit score for both FHA and conventional loans. Your credit score is a three-digit number showing how risky you are to lend money. A higher score means lower risk and better rates.

Most lenders use your FICO® Score, ranging from 350 (low) to 850 (high), is commonly used. VantageScore® may also be used. Your credit score and Information is reported by three main credit bureaus: Experian™, Equifax®, and TransUnion®. Your credit score may vary among credit bureaus.

If applying alone, the median score among the three is considered the ‘qualifying score’. With a co-borrower, the lowest median score is usually considered. Factors used to build your credit score include payment history, credit use, history length, new accounts, and credit types.

Regardless of the type of mortgage you use to buy a home, improving your credit score will have a positive impact.

FHA Loans

Credit score standards are generally less stringent for FHA loans than for conventional loans. You only need a credit score of 580 to qualify with 3.5% down. If your credit score is 500 to 579, FHA loan guidelines require you to put 10% down.

Conventional Loans

Requirements differ between lenders but, you typically need a credit score of at least 620 to be eligible for a conventional loan. However, some lenders might ask for a higher score than that.

If you have a co-borrower, Fannie Mae averages all borrowers’ scores. This can ease qualification. If one borrower scores 580 and the other 720, Fannie Mae averages them to set a qualifying score of 650.

For mortgage insurance cost, the lower median score matters. Rates might be a bit higher. This rule doesn’t apply to all Fannie Mae loans.

Property Type

FHA loans have more restrictions than conventional loans when it comes to the property itself. Not only are FHA loans limited to primary residences, but they also come with more explicit standards for the property’s condition.

FHA Loans

An FHA loan will require a home appraisal. The appraiser must follow strict requirements from the FHA to evaluate whether the property is safe, sound, and secure.

Here are a few standards the property must meet:

- Proper site drainage

- Safe drinking water

- Safe and comfortable heating

- Watertight roof with at least two years of life left

Conventional Loans

You can purchase your primary residence, secondary home, or investment property using a traditional mortgage. Qualifications are stricter for secondary homes and investment properties.

For instance, you need to put down a minimum of 10% to buy a secondary home and at least 15% to purchase an investment property.

Loan Limits

The maximum loan amount for FHA loans and conventional loans differs based on your location. Generally, FHA loans have lower limits compared to conventional loans. The amount you can borrow also relies on your income and debt capacity, meaning you might not qualify to borrow the full loan limit for your region.

FHA Loans

New loan limits change yearly for FHA loans. These limits vary based on where you want to buy a home in the U.S. In low-cost areas like rural Missouri, the highest limit is $498,257. In high-cost places like Orange County, California, it goes up to $1,149,825.

To find out the limit in your county, the best way is to check the HUD website for FHA mortgage limits. If you opt for an FHA loan instead of a conventional one, keep in mind that these limits could restrict the home price you can afford.

Conventional Loans

Conventional loans are subject to limits set by the Federal Housing Finance Agency (FHFA). For 2024, the conventional loan limit is $766,550 in most areas of the United States.

Debt-to-Income Ratio (DTI)

During the mortgage underwriting process, your lender will review your debt-to-income ratio (DTI). This ratio indicates the portion of your gross income allocated to debt monthly. It helps the lender assess if you can realistically manage the monthly mortgage payments you are seeking based on your current financial situation.

Below is the equation used to calculate your DTI:

(Total monthly debt) / (Gross monthly income) x 100 = DTI

FHA Loans:

FHA loans allow for a higher DTI of up to 50% in some cases. However, even with FHA loans, you’ll have to shop around if your debt-to-income ratio is above 45%. Because the FHA allows mortgage lenders to set their own in-house loan requirements, some may set stricter DTI requirements that are below 50%.

Conventional Loans:

You might qualify for a conventional mortgage with a DTI ratio up to 50%. Nonetheless, lenders typically prefer borrowers with a lower ratio.

Your debt-to-income ratio is just one factor lenders consider when assessing your financial details as you begin the loan pre-approval process.

When FHA Loans Make the Most Sense

FHA loans work well for those with lower credit scores and higher debt-to-income ratios who aim to own a home now instead of later when their financial situation improves. This could suit you if you’re buying a home for the first time.

Humans don’t think only about money when buying a home. Your personal situation might make owning a home more attractive than renting, even if you can’t secure the perfect mortgage.

When Conventional Loans Make the Most Sense

Because they’re generally cheaper in the long run, conventional loans are best for borrowers with higher credit scores and lower debt-to-income ratios. If any of the following sound like you, then a conventional loan makes the most sense.

- You can afford to put down 20%

- You’d like to have immediate equity in your home

- Your credit score is excellent

- You want a lower monthly mortgage payment

- You’re buying a second home or investment property

Key Takeaways From FHA Loans vs. Conventional Loans

When you’re trying to figure out whether to go with an FHA loan or a conventional loan, what you choose really hinges on how your finances are looking.

Opting for an FHA loan could be smarter if your credit score isn’t that high, your DTI ratio is a bit on the higher side, or if you don’t have a lot saved up for a down payment.

Conversely, going for a conventional loan might make more sense if your financial situation is solid and you can meet the requirements for getting good loan terms.

If you’re ready to get started on your home-buying journey, Helen Painter Group Realtors is here to offer our expertise and local knowledge.

A long-standing and trusted Fort Worth real estate agency, we’ve been serving buyers and sellers since 1958.

With over six decades of success behind us, you’ll surely have peace of mind knowing your best interests are being represented each step toward buying or selling a home.

To learn more or speak with an agent, feel free to give us a call at (817) 923-7321 or contact us.