For many homebuyers, especially those who can’t afford a hefty down payment, Private Mortgage Insurance (PMI) is an essential, yet often misunderstood, part of securing a mortgage.

PMI can help you get into a home without the traditional 20% down payment, but it comes with costs that add to your monthly mortgage payments.

This article will explain what PMI is, why it’s required, how much it costs, and ways to avoid or eventually eliminate it.

Let’s dive into the details to help you make informed decisions about your mortgage.

What is Private Mortgage Insurance?

Private Mortgage Insurance (PMI) is a type of insurance that lenders require when borrowers are unable to make a down payment of 20% or more on a home purchase. It protects lenders in case a borrower defaults on their mortgage. By offering this insurance, lenders are more willing to approve loans with lower down payments, giving buyers more flexibility.

PMI makes homeownership possible for many people who wouldn’t be able to meet the hefty 20% down payment requirement. However, while it benefits the lender, it adds an additional cost to your monthly mortgage payment. Understanding the ins and outs of PMI is essential for homebuyers trying to make informed financial decisions.

Is PMI Required for all Types of Mortgage Loans?

Not all mortgage loans require PMI. Conventional loans, which are not backed by government agencies like the Federal Housing Administration (FHA) or the U.S. Department of Veterans Affairs (VA), often require PMI when the borrower puts down less than 20%.

However, FHA loans come with their own mortgage insurance premium (MIP), which functions similarly to PMI. VA loans, on the other hand, do not require PMI, making them an attractive option for eligible veterans and active military personnel.

Government-backed loans like FHA and VA have different requirements and may include other forms of insurance, but PMI specifically applies to conventional loans. Knowing the type of loan you’re pursuing can help you understand if PMI will be part of your mortgage costs.

How Much Does PMI Cost?

The cost of PMI varies based on several factors. Generally, PMI premiums range between 0.46% and 1.5% of the original loan amount annually. The actual amount you’ll pay depends on your financial profile and the specific details of your mortgage.

For example, if you take out a $200,000 loan, your PMI could cost anywhere between $600 to $3,000 per year, which translates to an extra $50 to $250 per month on top of your mortgage payment. These costs can add up, so it’s essential to know what influences PMI premiums.

What Factors Influence the Cost of PMI?

Several factors determine how much you’ll pay for PMI:

- Loan-to-Value Ratio (LTV): The LTV ratio is a key factor. The higher the LTV (i.e., the smaller your down payment), the higher your PMI premiums will be. For example, a borrower putting 5% down (95% LTV) will typically pay more in PMI than someone who puts down 15% (85% LTV).

- Credit Score: Your credit score significantly impacts PMI costs. Borrowers with higher credit scores are seen as less risky and may pay lower premiums. Conversely, those with lower credit scores may face higher PMI rates.

- Loan Type: Fixed-rate loans often have different PMI costs compared to adjustable-rate mortgages (ARMs). In general, ARMs can have slightly higher PMI rates due to the potential volatility in payments over time.

- Loan Size: Larger loans may carry higher PMI premiums because they represent more risk for lenders.

PMI Cost Example

Let’s illustrate PMI with an example. Suppose you’re purchasing a $350,000 home with a 10% down payment, meaning you’re borrowing $315,000. With an average PMI rate of 1%, your annual PMI would be $3,150 or about $262.50 per month.

If your credit score is on the lower end, say around 620, your PMI rate could jump to 1.5%, increasing your annual PMI to $4,725, or nearly $393.75 per month. This example highlights how significant the difference in PMI costs can be based on just a few variables, like your credit score and down payment size.

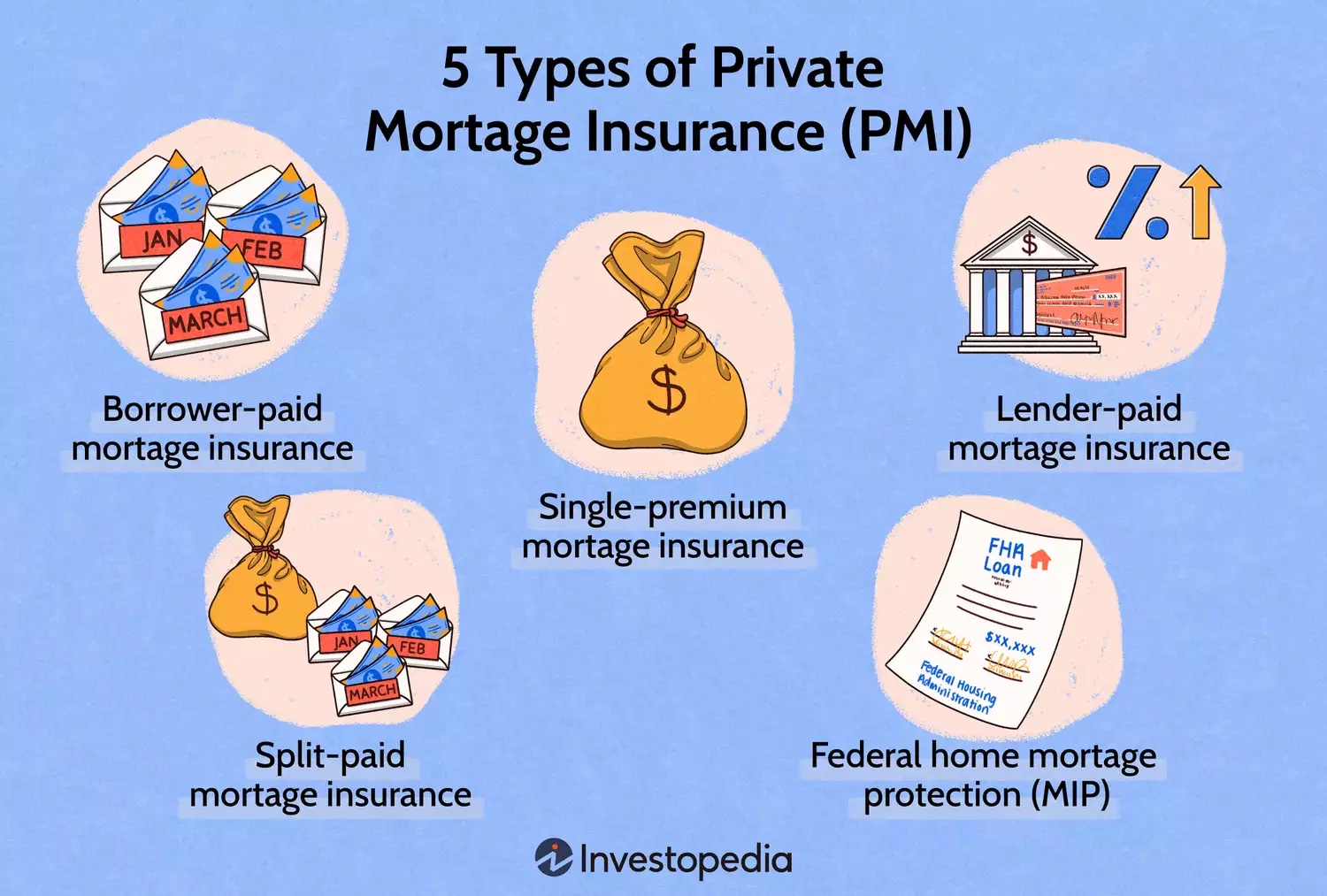

Image by: Investopedia

Types of Private Mortgage Insurance (PMI)

There are several types of PMI, each with different structures for how premiums are paid. Understanding the differences can help you choose the one that best fits your financial situation and long-term goals.

1. Borrower-Paid Mortgage Insurance (BPMI)

Borrower-Paid Mortgage Insurance (BPMI) is the most common type of PMI. As the name suggests, the borrower pays the PMI premium each month as part of their mortgage payment. The borrower continues paying BPMI until they reach 20% equity in the home, at which point PMI can be canceled.

BPMI is generally straightforward, and while it increases monthly payments, it allows borrowers to cancel PMI once they have built enough equity, making it an appealing option for those looking for flexibility.

2. Lender-Paid Mortgage Insurance (LPMI)

In Lender-Paid Mortgage Insurance (LPMI), the lender pays the PMI premiums on your behalf, but the tradeoff is typically a higher interest rate on your loan. While this means there’s no separate PMI payment, the increased interest rate can add significant costs over the life of the loan.

LPMI can be a good option for buyers who don’t want the hassle of paying PMI monthly. However, since the interest rate increase is permanent, it’s essential to weigh the long-term costs against the benefits of eliminating monthly PMI premiums.

3. Single-Premium Mortgage Insurance (SPMI)

With Single-Premium PMI, you pay the entire cost of PMI upfront, either at closing or by financing it into your mortgage. This eliminates the need for monthly PMI payments, reducing the borrower’s overall mortgage payment.

The trade-off with Single-Premium PMI is that it requires a significant upfront cost, which can be challenging for buyers who are already stretching their finances for a down payment and closing costs. However, it can be a good option for those who want to lower their monthly expenses.

4. Split-Premium Mortgage Insurance

Split-Premium Mortgage Insurance is a hybrid of Borrower-Paid and Single-Premium PMI. With Split Premium, the borrower pays part of the PMI upfront and the rest in monthly installments. This option reduces the upfront cost compared to Single-Premium PMI while also lowering monthly payments compared to BPMI.

Split Premium PMI can offer the best of both worlds for borrowers who want to minimize both their upfront and monthly costs, but it’s essential to calculate the total expense to determine if it’s the most cost-effective solution.

5. Federal Home Loan Mortgage Insurance Premium (MIP)

An additional type of mortgage insurance is associated with loans insured by the Federal Housing Administration (FHA). The FHA insures these loans to protect lenders against borrower default. In return, FHA mortgage loans offer borrowers benefits such as a down payment as low as 3.5%, making them particularly attractive for first-time homebuyers. FHA loans are designed to assist those who cannot afford the traditional 20% down payment.

However, FHA mortgages require borrowers to pay a mortgage insurance premium (MIP). Additionally, homes must meet specific livability criteria to qualify for MIP coverage; otherwise, they are deemed uninsurable.

Moreover, MIP cannot be removed without refinancing the home. It consists of both an upfront payment and monthly premiums, which are typically added to the monthly mortgage payment. If a borrower makes a down payment of more than 10%, they must wait 11 years before they can remove the MIP from the loan.

Should You Pay PMI?

Whether or not you should pay PMI depends on your financial situation and long-term goals. For many first-time homebuyers, PMI is a necessary cost to get into a home sooner without needing a 20% down payment. By making smaller down payments, borrowers can allocate their savings for other priorities, such as home improvements or emergency funds.

However, if you have the means to put down 20% or more, avoiding PMI altogether can save you thousands of dollars in the long run. It’s also worth considering alternatives, such as VA loans for eligible buyers or piggyback loans, which combine a first and second mortgage to avoid PMI.

How to Avoid Paying PMI

There are several strategies to avoid paying PMI, but they often require larger upfront investments or specific loan programs. Some common methods include:

- Make a 20% Down Payment: The most straightforward way to avoid PMI is to put down at least 20% of the home’s purchase price.

- Piggyback Loan: Some buyers use a “piggyback loan,” also known as an 80-10-10 loan, where they take out two loans: one for 80% of the purchase price and another for 10%. The remaining 10% is the buyer’s down payment, allowing them to avoid PMI.

- VA Loans: If you’re a veteran, active-duty service member, or eligible surviving spouse, you may qualify for a VA loan, which doesn’t require PMI.

- Lender-Paid PMI Options: Opting for LPMI eliminates monthly PMI, though it may result in a higher interest rate.

By planning ahead and weighing your options, you can minimize or completely avoid the cost of PMI.

How to Get Rid of PMI

If you’re already paying PMI, there are ways to get rid of it:

- Automatic Termination: Under the Homeowners Protection Act, lenders must automatically cancel PMI once you reach 22% equity in your home, based on the original purchase price.

- Request PMI Cancellation: You can request PMI cancellation once you’ve paid down your mortgage to the point where you have 20% equity in your home. To initiate this, you’ll likely need to provide an appraisal or other proof of your home’s current value.

- Refinance Your Mortgage: If your home has appreciated in value since you purchased it, refinancing could allow you to get rid of PMI. By refinancing to a new loan with a lower loan-to-value ratio (below 80%), you can eliminate the need for PMI.

Key Takeaways: What is Private Mortgage Insurance (PMI)?

Private Mortgage Insurance (PMI) protects lenders in case of borrower default and is typically required for conventional loans when the borrower puts down less than 20%.

While it can add to your monthly payments, PMI enables many homebuyers to purchase a home with a smaller down payment.

There are different types of PMI to fit various financial situations, and once you reach 20% equity, you may be able to cancel it.

Understanding how PMI works and how to avoid or eliminate it can save you money in the long run.

If you’re ready to get started on your home-buying journey, Helen Painter Group Realtors is here to offer our expertise and local knowledge.

A long-standing and trusted Fort Worth real estate agency, we’ve been serving buyers and sellers since 1958.

With over six decades of success behind us, you’ll surely have peace of mind knowing your best interests are being represented each step toward buying or selling a home.

To learn more or speak with an agent, feel free to give us a call at (817) 923-7321 or contact us.

PMI FAQs

How do I Make PMI Payments?

PMI payments are typically made as part of your monthly mortgage payment. The premium is included in your escrow account, along with your property taxes and homeowners insurance.

Do Lenders Require PMI?

Yes, most lenders require PMI for conventional loans with down payments of less than 20%. It reduces the lender’s risk, making it more likely for them to approve your loan. However, certain government-backed loans, such as VA loans, do not require PMI.

How Long Will I Pay for PMI?

You’ll pay PMI until you’ve reached 20 percent equity in your home, or an 80% loan-to-value (LTV) ratio on your mortgage. Loan servicers must cancel PMI once you reach a 78% percent LTV ratio, based on the home’s original appraised value, or halfway through your loan’s term (15 years into a 30-year mortgage, for example). Lender-paid PMI cannot be canceled, as it’s built into the loan.