First-time home buyers with a modest income might find good loan choices other than a regular mortgage, such as FHA and USDA loans.

Although these are both government-backed loans, they have unique differences and benefits.

USDA loans are helpful for people with middle to lower incomes wanting to purchase homes in somewhat rural areas.

On the other hand, FHA loans are suitable for those who’ve saved a small down payment but don’t have a good credit score.

A low credit score will make it difficult to get a fair interest rate on a conventional mortgage or even qualify for one.

So, let’s compare USDA vs. FHA loans to figure out which one – if any – fits your situation and requirements.

What is a USDA Loan?

A USDA loan is a mortgage program from the U.S. Department of Agriculture (USDA) that helps low- and moderate-income people buy, build, or repair homes in rural areas and smaller towns. USDA loans are designed to be more affordable than conventional loans, with features like no down payment, lower interest rates, and government-issued mortgage insurance.

To be eligible for a USDA loan, the home you wish to purchase must be in a rural or suburban area. The USDA’s definition of ‘rural’ is broader than you might expect. Check the USDA’s eligibility map to see if your location qualifies. There are two kinds of USDA loans.

- Single Family Direct Loans: Target buyers with low or very low incomes who aim to buy a house in a rural setting. These loans have terms of up to 33 years — 38 years for very-low-income individuals — with no down payment necessary and financial help for borrowers. From 2022 onward, Single Family Direct Loans carry a fixed interest rate of 2.5%.

- Single Family Housing Guaranteed Loans: Shares similarities with FHA loans. It’s backed by the USDA and provided by approved private lenders. Lenders participating in this program can have up to 90% of the loan amount insured by the USDA.

If you qualify for a USDA loan, you won’t need a down payment. However, you’ll need to pay a funding fee, which serves as insurance. The fee amount may vary but cannot exceed 3.5% upfront and 0.5% of the average annual unpaid balance monthly.

What is an FHA Loan?

An FHA loan is insured by the Federal Housing Administration (FHA) to protect the FHA-approved lender in case the borrower fails to pay back the loan. Essentially, FHA loans aid individuals who might not otherwise meet the requirements to obtain financing for a home purchase. Like conventional mortgages, FHA loans are available with a 15- or 30-year term. The loan’s interest rate can be fixed or adjustable.

You are required to make a down payment when purchasing a house with an FHA loan. The down payment must be at least 3.5% of the purchase price, but you can choose to put down up to 10%. If you can afford to put down more than 10%, it’s often wise to explore other mortgage options, like conventional mortgage loans.

In return for more flexible requirements and government insurance, FHA loans mandate borrowers to pay mortgage insurance. This insurance has two parts. The first premium, paid upfront, is 1.75% of the borrowed amount. The second premium is paid monthly. It varies from 0.45% to 1.05%, depending on your down payment size and loan term. The smaller your down payment, the larger the insurance premium.

The amount you put down also impacts how long the insurance premium lasts. If you bought a home with less than a 10% down payment, you must pay the premium for the entire life of the mortgage. With a 10% or higher down payment, you can cease paying the premium after making on-time, monthly payments for 11 years.

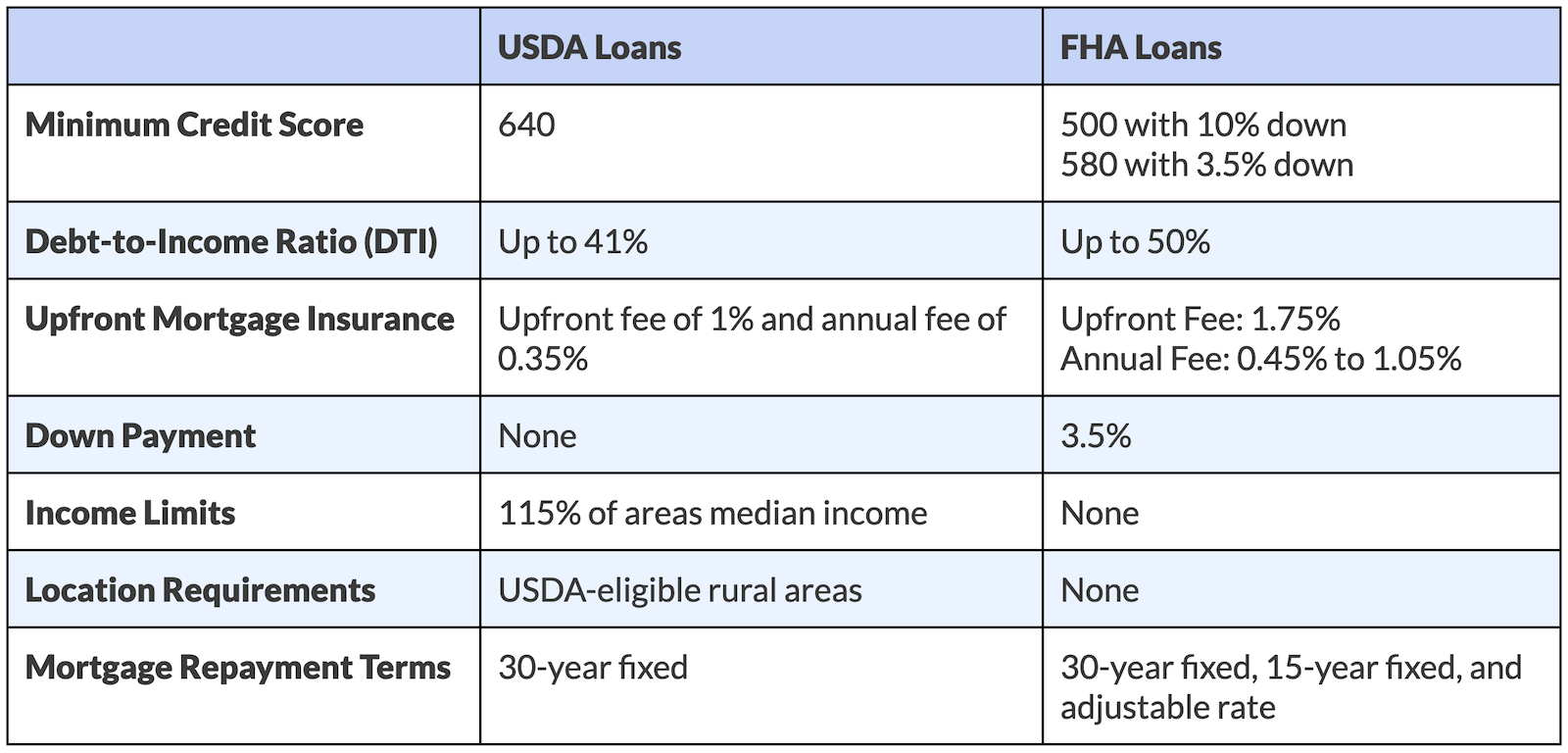

USDA Loans vs. FHA Loans: Key Differences

When you’re faced with the decision of whether to go with a USDA loan or an FHA loan, it can often feel like a tough choice. Even though some of the requirements may overlap, there are key differences that set them apart from each other.

To help you understand the differences better, take a look at the table provided below. It highlights the essential factors you should consider when comparing USDA vs. FHA loans.

Let’s explore the specifics of several factors and understand situations when one loan type might be more favorable than the other.

Mortgage Approval Process

FHA and USDA loans need specific documents for approval, such as an ID, pay stubs, and tax returns. You might also have to provide extra paperwork depending on the loan and your mortgage lender.

Consider getting mortgage pre-approval for your FHA or USDA loan to speed up the process. Even with preapproval, it could take 30 to 45 days to finish the loan and close on the home.

The USDA home loan process might be longer than an FHA loan because USDA loans go through double underwriting—first by the lender and then by the USDA.

The home must undergo an appraisal by both USDA and FHA to guarantee you’re paying a fair price, but USDA loans skip the home inspection step.

FHA loans come with their own set of requirements that could extend the timeline. Your lender will need an appraisal and inspection from an FHA-approved appraiser before closing.

Once you close, you’re expected to move into the home within 60 days and live there as your main residence for at least a year. Failing to meet these conditions could lead to legal issues.

Down Payment Requirements

USDA and FHA loans are meant to assist borrowers who may find it challenging to meet the down payment needed for typical loans. USDA loans do not call for a down payment. However, if you opt to make a down payment, you’ll probably reduce your monthly mortgage payments and the interest rate on the loan.

For an FHA loan, with a credit score ranging from 500 to 579, a down payment of at least 10% of the home’s purchase price is required. If your credit score is 580 or higher, FHA mandates a minimum 3.5% down payment. Similar to USDA loans, a larger down payment could lead to lower interest rates and monthly mortgage payments.

Mortgage Insurance

Mortgage insurance is included when you apply for either an FHA or a USDA loan. However, the amount you pay for mortgage insurance can differ based on the program you select.

For FHA loans, the mortgage insurance premiums are higher compared to USDA loans, especially if you make a smaller down payment. If you deposit the minimum 3.5%, your monthly mortgage insurance premium will be 0.85% of the loan amount. This premium must be paid throughout the entire mortgage term, in addition to the upfront payment of 1.75%.

Regarding USDA loans, the required premiums, known as the funding fee, do not exceed 0.5% of the remaining balance and 3.75% upfront. You will be required to pay the monthly premium for the entire term of the USDA loan.

Income Requirements

If you’re considering an FHA loan, your income isn’t a deciding factor. There are no specific income limits, but you must demonstrate a stable income that can cover your loan. Typically, you’ll have to show tax returns, pay stubs, and work verification during the application process.

With the USDA loan program, there are income restrictions. Your earnings shouldn’t exceed 115% of the average income in your region. Because living costs and salaries differ across states, some areas allow higher income thresholds. You can verify your eligibility based on your location through the USDA’s website.

Credit Score

Your credit score affects getting a mortgage to buy a home. For FHA or USDA loans, it’s less crucial than for conventional mortgages. These loans have more flexible credit criteria. USDA loans don’t have fixed credit requirements, but lenders may suggest a score above 640.

FHA loan credit requirements determine your down payment. If your score ranges from 500 to less than 580, you’ll need 10% down for an FHA loan. Scores above 580 allow down payments as low as 3.5%.

Debt-to-Income Ratio (DTI)

During the mortgage underwriting process, your lender will review your debt-to-income ratio (DTI). This ratio indicates the portion of your gross income allocated to debt monthly. It helps the lender assess if you can realistically manage the monthly mortgage payments you are seeking based on your current financial situation.

Below is the equation used to calculate your DTI:

(Total monthly debt) / (Gross monthly income) x 100 = DTI

Loan Terms

The duration of your mortgage can change based on whether you opt for a USDA or FHA loan. FHA loans come in 15- or 30-year options. Choosing between a 15- or 30-year mortgage depends on your income and goals.

A 15-year mortgage typically offers a lower interest rate than a 30-year one. However, the monthly payments are usually higher with a 15-year loan. One advantage of a 15-year mortgage is that you repay it faster.

On the other hand, 30-year mortgages generally have slightly higher interest rates but lower monthly payments, which can help in making home buying more affordable. If you prefer a USDA loan, you’re unable to pick a 15-year term.

Closing Costs

With both a USDA and an FHA loan, the borrower must pay closing costs. However, how these costs are managed can vary.

For a USDA loan, you may borrow more than the home’s value and use the extra funds to cover closing expenses. This flexibility is generally not available with an FHA loan.

Financing part or all of the closing costs can help make purchasing a home more feasible. An FHA loan permits the acceptance of seller concessions or a seller assist.

In a buyer’s market—where there are more homes for sale than buyers—you could negotiate for the seller to contribute towards your closing expenses. Obtaining a seller assist is typically more challenging in a seller’s market, characterized by more buyers than available homes.

Property Requirements

The requirements for buying a home with a USDA or FHA loan are a bit different. Besides meeting location rules, a home bought with USDA has to meet specific livability standards, primarily being safe and your main residence.

For an FHA loan home, it must meet HUD health and safety regulations. As part of the loan process, an appraisal is necessary. The appraiser determines not just the home’s value but also its overall condition and safety compliance.

With an FHA loan home, it’s necessary to reside there, and properties with multiple units are eligible for this type of mortgage.

For USDA loans, a home inspection isn’t obligatory. Still, it’s wise to inspect the property before buying to uncover any major hidden issues. If problems arise during the inspection, you can discuss them with the seller.

USDA vs. FHA Loans: What Type of Mortgage Should You Choose?

If you’re interested in both USDA loans and FHA loans and could qualify for either, you may be wondering which would be a better fit for you. Let’s break down some of the reasons you might lean toward an FHA or USDA loan.

USDA Loan Pros & Cons

USDA loans offer borrowers several important advantages, however, it’s important to weigh those against the disadvantages. This will provide a balanced assessment and enable you to make an informed decision regarding the type of mortgage you choose.

USDA Loan Pros

Here are some good reasons to consider a USDA loan:

- No Minimum Down Payment: USDA loans don’t ask for a down payment, unlike conventional and FHA loans.

- Lower Mortgage Insurance Costs: The initial USDA guarantee fee is 1% of the loan amount, and the yearly fee is 0.35%. These rates are cheaper compared to FHA insurance premiums.

- May Not Need Cash Reserves: Lenders might not need cash reserves to approve your loan. However, showing your savings could make it easier to qualify.

- No Defined Maximum Purchase Price: With USDA loans, there’s no borrowing limit set. Your loan amount is based on what you can repay.

- Seller Can Cover Closing Costs: Sellers can contribute up to 6% of the sale price. You can also get gift funds to lower your loan amount.

USDA Loan Cons

These are the main drawbacks of this loan program:

- Good Credit Needed: You must have at least a 640 credit score to qualify, similar to what conventional lenders require. FHA lenders might accept scores of 580 or lower.

- Geographic Limits: To get USDA financing, you must live in a rural area. However, some suburban and bedroom communities might qualify if their population is below a certain level.

- Single-Family Homes Only: Only single-family homes qualify for USDA loans, including townhouses and condos for your primary residence. Investment properties are not eligible.

- Income Limits: For a USDA Guaranteed Loan, your household income can’t go over 115% of your county’s median income. Lower-income households may need a USDA Direct Loan, which can have stricter criteria but doesn’t need a down payment.

- Lifetime Guarantee Fee: USDA loans require an upfront and yearly fee for the whole loan period. Unlike FHA and conventional loans, making a down payment won’t affect your need to pay mortgage insurance.

FHA Loan Pros & Cons

FHA loans are a good option, especially if you have low credit or a lot of debt. But they come with their own set of drawbacks too.

FHA Loan Pros:

Some good reasons to get an FHA home loan are:

- Easy Credit Requirements: With a credit score of 580, you can usually get the most funding with an FHA loan, compared to needing a score of 640 for a USDA loan. If you can manage a 10% down payment, you might qualify with a score between 500 and 579.

- Higher Debt-to-Income Flexibility: For FHA loans, you can have a total monthly debt of up to 45% (back-end DTI), while USDA loans allow only up to 41%.

- Possibly Lower Interest Rates: FHA offers lower interest compared to USDA loans because you can opt for shorter repayment terms, like a 15-year fixed interest rate. USDA, in contrast, only provides 30-year fixed loans with higher rates.

- Multi-Family Unit Eligibility: An FHA loan can finance properties with up to four units, provided you live in one as your main residence. For instance, buying a duplex using an FHA loan is fine as long as you reside in half of the property. Second homes and investment properties are not eligible, like with USDA loans.

FHA Loan Cons:

- Higher Down Payment Demands: Depending on your credit score, you’ll need to put down either 3.5% or 10%. USDA loans, on the other hand, require no down payment.

- Increased Mortgage Insurance Costs: FHA involves higher upfront and yearly mortgage insurance premiums compared to the fees with USDA loans.

- Tough to Remove Mortgage Insurance: Unless you put down at least 10%, you will pay an annual mortgage insurance premium throughout the loan’s life, or for 11 years if you put down 10%.

- Loan Limits: In 2024, the maximum loan amount in most counties is $498,257. Higher limits are available for residents in high-cost regions.

Key Takeaways From Comparing USDA Loans vs. FHA Loans

A USDA loan is probably your top choice if you’re eyeing a home in a rural area and you qualify income-wise.

If a conventional loan isn’t an option for you and you aim to cut down on initial home-buying costs, consider an FHA loan as it offers more flexibility on where you can buy a home.

These government-supported loans can assist in tackling financial challenges and funding your ideal home.

If you’re ready to get started on your home-buying journey, Helen Painter Group Realtors is here to offer our expertise and local knowledge.

A long-standing and trusted Fort Worth real estate agency, we’ve been serving buyers and sellers since 1958.

With over six decades of success behind us, you’ll surely have peace of mind knowing your best interests are being represented each step toward buying or selling a home.

To learn more or speak with an agent, feel free to give us a call at (817) 923-7321 or contact us.