If you’re looking at buying a home, you’ll want to determine how much house you can afford before you go shopping around.

But creating a home-buying budget is more complicated than it sounds.

You might be tempted to think you can just swap a mortgage payment for whatever you’re paying in rent as your housing budget, but this tactic ignores many of the expenses that come with homeownership.

The last thing you want to do is get into a house you love, only to realize that you must sacrifice all the other luxuries in life to afford it.

In this article, we’ll help you prevent this situation by giving you a step-by-step guide to determine your home-buying budget.

Determining your home buying budget is even more important if you’re planning to sell and buy a house at the same time.

How to Determine Your Home Buying Budget

Determining how much home you can afford to buy shouldn’t be a guess or even a ballpark estimate.

For most people, housing is the largest expense they pay each month, so it’s important to get this right.

Trying to buy a more expensive home than your budget will allow is a common mortgage shopping mistake that’s easy to avoid with forethought and planning.

If you’re not sure how to calculate how much house you can afford, you can use the “28/36” Rule.

This rule of thumb will help ensure that you don’t commit too much money to your housing budget and get in over your head.

What is the 28/36 Rule?

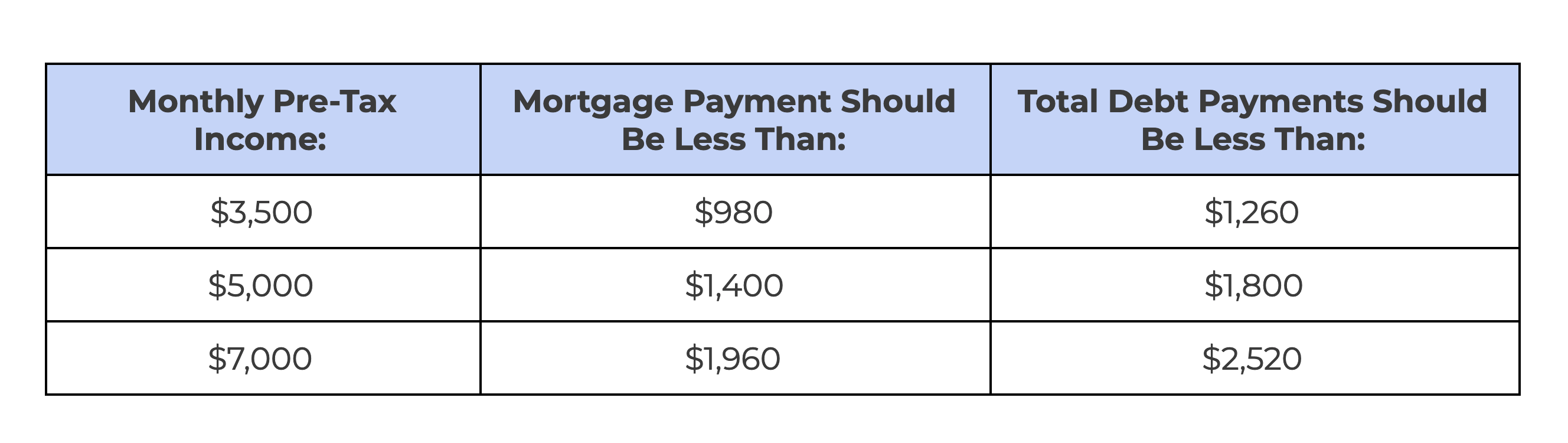

The 28/36 Rule states your monthly mortgage payment (including principal, interest, insurance, and taxes) should be no more than 28% of your pre-tax income, and your total debts should be no more than 36%.

Here’s what this looks like in a few real-life examples:

The 28/36 Rule doesn’t come out of thin air; these are the ratios lenders use to determine if you can qualify for a conventional mortgage.

While other mortgage types (VA, FHA, etc.) may have more lenient requirements for the amount your debts and mortgage costs can be, it’s a good idea to stick with the 28/36 Rule to make sure you don’t commit to a higher housing cost than your finances can comfortably handle.

How Do I Calculate My Home Buying Budget?

Once you’ve determined what you can afford with the back-of-the-napkin math of the 28/36 rule, it’s time to dive further into your finances to see what really makes sense for you.

Here are the steps that outline exactly how to calculate what you can afford to spend on housing (i.e., your mortgage payment plus insurance, taxes, repairs, and fees).

1. Estimate Your Gross Monthly Income

Most ratios lenders use to determine whether to approve you for a mortgage (such as debt-to-income ratio) are based on your gross monthly income.

This is the sum of all your forms of income before taxes and withholdings (such as 401k contributions or healthcare premiums) are deducted.

Calculating your gross monthly income depends on how you’re paid:

- Annual Salary – If you’re paid with an annual salary, you’re likely paid once or twice a month. Simply take the total amount that you make in a month (again, that’s before taxes and other deductions) to find your gross monthly income. This should be a separate box on your pay stub.

- Hourly Wage – If you make an hourly wage, multiply the average number of hours you work per week by your hourly wage. Then, multiply that by 52 weeks per year, then divide by 12 months. If your hours are variable, err on the conservative side. Don’t count overtime unless it’s very consistent.

- Commision-Based Income – If you work on commission, take the total amount of gross sales you make annually and multiply it by the percentage you receive as commission. Add in your base salary, then divide by 12 months.

2. Evaluate Current Debt

In addition to your current income, lenders also want to know about your existing debt [credit cards, car payments, medical bills, student loans, tax liens, etc.].

Though having consumer debt won’t necessarily prevent you from getting a mortgage, reducing or eliminating your high-interest debts before seeking a large loan makes good financial sense.

Doing so will raise your credit score, free up monthly cash flow, and give you a better debt-to-income ratio, making you a more desirable mortgage applicant.

3. Analyze Monthly Expenses

Before you take on a large monthly expense like a mortgage payment, it’s important to know how your input and outgo compare.

To do this, you must have a clear understanding of your monthly expenses.

The numbers below will give you a good benchmark to work with, but your numbers will vary based on the size of your household, your location, needs, and spending habits.

Average Monthly Expenditures

The average monthly expenditures were calculated using data from the Bureau of Labor Statistics.

Food: $610

Clothing: $120

Gas: $130

Healthcare: $431

Entertainment: $242

Personal care: $54

Miscellaneous: $76

Average Monthly Utility Costs in the US

The average monthly utility costs in the US are from Move.org.

Electricity: $114.44

Natural gas: $63.34

Water: $70.93

Streaming services: $47.43

Broadband internet: $60

Trash/recycling: $14.032

If you’ve never used a formal budget before, start by tracking your spending in a notebook or online spreadsheet.

Even a few months of data will reveal where your spending priorities are, and how much bandwidth you have for a mortgage payment.

4. Check Credit History

Lenders will pull your credit report when you apply for a mortgage from one of the three credit bureaus: Equifax, Experian, and TransUnion.

Your credit report is a comprehensive list of all open and closed credit accounts, including how much you owe and to whom, whether your payments were on time, and more.

Creditors like to see borrowers who have a strong history of handling the amount of credit they have.

They want to see regular, on-time payments, and a low credit utilization rate.

Credit Utilization

Credit utilization is how much debt you can still incur on revolving accounts, such as credit cards and HELOCs.

It’s expressed as the total balance of your revolving debts divided by the total credit limit on those accounts.

So if you had a $10,000 balance on a HELOC of up to $30,000 as well as a $3,000 balance on a credit card with a $5,000 limit, your credit utilization would be about 37%.

Experts recommend keeping your credit utilization on any given account at no more than 30%.

If a bank sees a borrower with maxed-out credit cards or a HELOC that is near its limit, that’s a big red flag.

Credit Report

Your credit utilization and the information in your credit report are used to establish a credit score, also known as a FICO score.

Think of your credit score as a report card on how well you’re handling your credit accounts.

Credit scores range from 300 – 850.

While higher is always better, here’s a breakdown of what each range of credit score looks like to a lender.

You are entitled to a free copy of your credit report (which may not include your exact credit score) every year from each of the three credit reporting companies.

To get your credit report, call Annual Credit Report at 1-877-322-8228 or visit AnnualCreditReport.com.

How Does Bad Credit Affect Your Home Buying Options?

Bad credit seriously limits your buying options for a home.

Lenders often require borrowers with poor credit to pay higher interest rates, higher down payments, and/or have a co-signer in order to qualify for a mortgage.

If your credit is extremely poor, you may not qualify for a mortgage at all.

How Does Good Credit Affect Your Home Buying Options?

Having a good credit score assures that you will get a decent interest rate for a loan.

You will have your choice of which type of mortgage you qualify for.

As a top-quality borrower, you’ll also enjoy negotiating power when getting banks to compete for your business.

5. Research Mortgage Options

Mortgages come in different shapes and sizes, so it’s important to research the many mortgage options so you can make the most informed decision.

Buyers have two main types of mortgages to choose from:

- A conventional loan that is guaranteed by a private lender or banking institution

- A government-backed loan

When choosing a loan, you’ll want to explore the types of rates and the terms for each option.

There may also be a mortgage suited to individual circumstances, such as for veterans or first-time home buyers.

If you aren’t sure where to begin, you should check out our guide on finding a mortgage lender.

Conventional Loans

Since a conventional mortgage is backed by the lending institution, they set the terms for the loan.

You’ll likely need a 620 credit score or higher to qualify.

The down payments for these loans range from 3% – 20%.

Because there are no government regulations on property location or condition, conventional loans offer maximum flexibility for buyers on what type of property they can get a mortgage for.

Government-Backed Loans

Most government-backed loans aim to serve specific populations or circumstances, such as people with minimal savings, or people in rural areas.

Many of these loan options require a minimal down payment (0% down for VA loans and 3.5% down for FHA) and have more relaxed credit score requirements.

However, these mortgages may come with extra fees or mortgage insurance — some of which can only be eliminated through refinancing.

Fixed-Rate vs. Adjustable Rate Mortgages

The interest rate on each mortgage type can come in one of two flavors: a fixed rate or an adjustable rate.

Fixed interest rates stay the same for the life of the loan, but (as the name suggests) adjustable interest rates can adjust on an annual or monthly basis.

The initial interest rates on an adjustable-rate mortgage (or ARM) may be lower than a comparable fixed-rate mortgage, so an ARM might be ideal for a borrower who is not planning to be in the home for long.

However, a fixed-rate mortgage assures that there will be no unpleasant surprises or unmanageable payments for the borrower in the future.

6. Get Pre-Approved for a Mortgage

Getting a mortgage pre-approval means that a mortgage lender has reviewed your income, expenses, and credit report and has conditionally agreed to loan you a set amount of money for a mortgage.

This enables you to look for a home at or below that price level with confidence.

This is an important step in the mortgage loan process, as having pre-approval will also encourage sellers to take you seriously as a buyer.

You’ll be in a stronger position to negotiate your home purchase.

Talking to lenders will give you a feel for the types of home loans you may be able to qualify for.

You’ll be able to ask about terms, interest rates, credit score requirements, and debt-to-income ratio (DTI).

Speak with multiple lenders in order to find the best rate.

Each one will pull your credit for the pre-approval process, but if you do this within a 45-day window, it will only count as one inquiry on your credit report.

It’s important to remember that pre-approval doesn’t mean you’re committed to proceeding to a loan agreement.

You can always shop around later for a better deal once you’ve decided on a house.

7. Research Upfront Costs

Lenders are required to outline and disclose your total closing costs before your closing date.

This is done in the closing disclosure document, which must be presented to the buyer three days prior to closing on a house.

On this document, you’ll see the exact loan terms (loan amount, down payment, interest rate, any prepayment penalties or balloon payment requirements) as well as individual closing costs, such as origination fees, underwriting fees, attorneys charges, taxes, and more.

The sum of all closing costs is usually around 2%-5% of your total loan amount.

8. Factor in Homeowner Costs

Beyond the direct costs of purchasing a home, you also need to consider expenses related to owning and maintaining a home, many of which you may not have had as a renter.

In your homeownership budget, make sure you account for the expenses below.

Homeowner’s Insurance

If you have a mortgage on your home, you’ll need to carry homeowner’s insurance (and even if you don’t have a mortgage, it’s still a good idea to insure your home).

This covers you in the event of a disaster that damages your home, such as a tornado or earthquake.

Property Taxes

Now that you own a home, you’ll have to pay property taxes on it each year.

You can get a good idea of how much the tax bill will be by asking the county clerk about the tax history on a property you are planning to buy.

Maintenance & Repairs

When you rent a home, the landlord takes care of replacing leaky faucets, broken doors, or faulty appliances.

After you buy a home, you become your own landlord.

While there’s no crystal ball that will let you see exactly what repairs will cost you in the future, experts suggest setting aside 1% of your home’s value each year for repairs and maintenance.

For example, this would be $2,500 annually on a $250,000 home.

HOAs

If your home is governed by a homeowner’s association, you’ll be required to pay the appropriate fees.

These vary greatly, so contact the HOA that oversees the home you’re looking at to get an idea of what the cost will be.

Final Thoughts on Creating a Home Buying Budget

Determining how much house you can buy goes much further than calculating the mortgage payment and comparing it with the amount of your current rent.

Before you can enjoy the benefits of homeownership, you’ll need to take a deep dive into your financial picture to assess how much debt you’re ready to take on and find a home that fits your budget.

Remember to factor in all the extras that you don’t have to worry about as a renter — taxes, repairs, homeowner’s insurance, and additional fees.

If you need help locating a home that fits your budget, enlist the help of a trustworthy real estate agent from Helen Painter Group Realtors.

Whether you’re looking for your first starter home, buying a fixer-upper or a luxury property, our experienced agents will help you find the right home, in the best neighborhood at the right price.

We can also help connect you with a mortgage lender that can walk you through your options to make the home buying experience a great one.

If you’re looking to buy a home in Texas, give Helen Painter Real Estate Group a call for your free consultation.