The housing market is hot right now — in the same way, that molten lava and the surface of Mercury are hot.

In many metro areas, houses are on the market for a matter of minutes, and buyers are scrambling to get in an offer before their house disappears faster than toilet paper in 2020.

Navigating this uber-hot sellers’ market is made increasingly complicated by coronavirus, and not just because you have to do virtual Zoom walkthroughs.

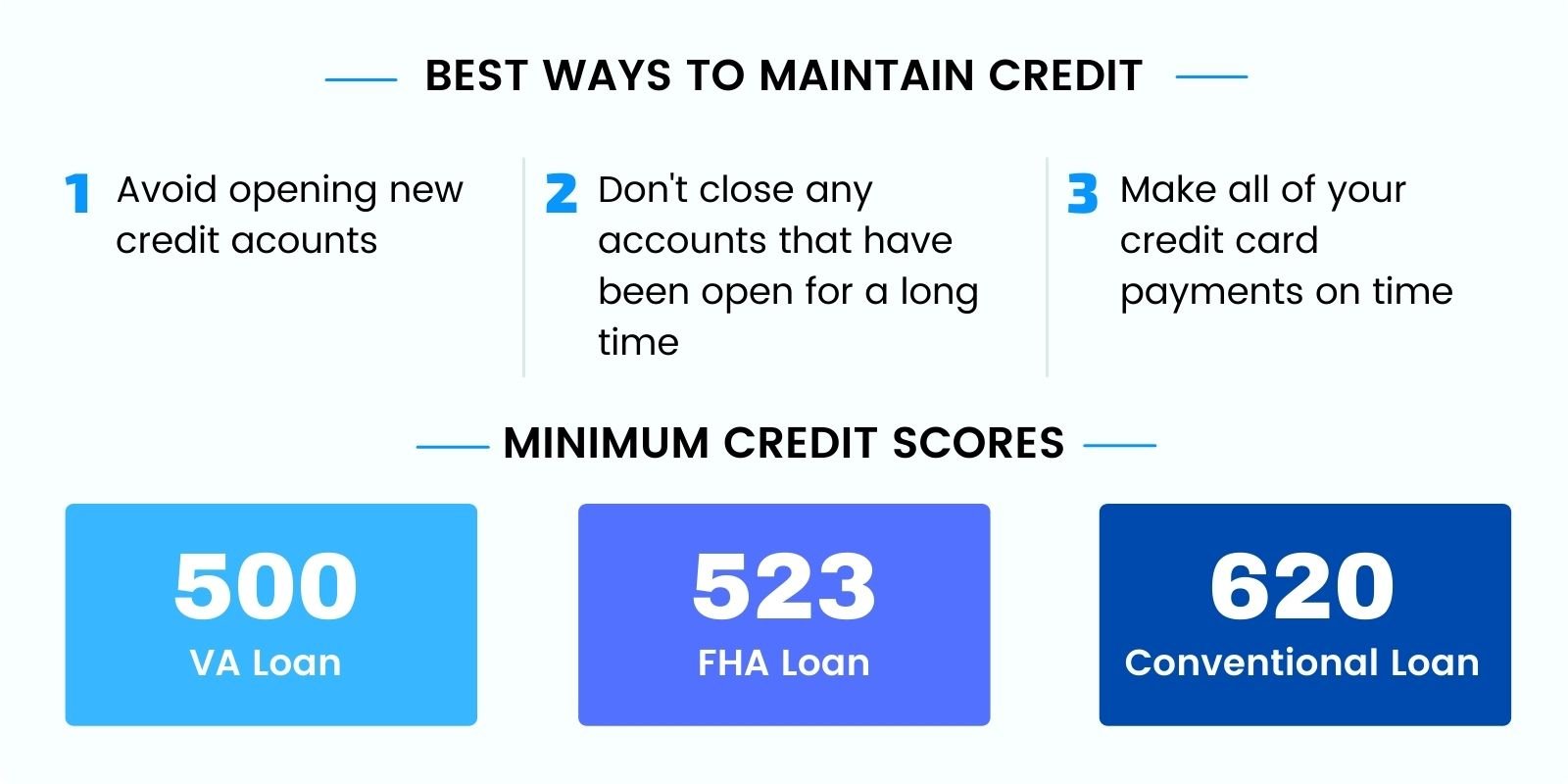

In the face of an economic downturn, lenders are tightening their belts by raising the minimum credit score and requiring more down payments to decrease their risk of defaulting borrowers.

With less access to mortgages and fewer houses to choose from, buying a home in 2021 can seem like more of a feat than in years past.

Rest assured, however, that people are still selling and buying real estate, though many aspects of the process are evolving with the unprecedented times.

In this article, we’ll give you a step-by-step guide to optimizing your buying position and show you how to buy a house and enjoy the benefits of homeownership in the 2021 real estate market in Texas.

1. Evaluate Your Financial Situation

Before you start scrolling through property listings, take a good long look at your balance sheet to determine if you’re ready for homeownership.

In the likely event that you take out a mortgage to buy a home, it’s important to understand how your financial situation impacts your buying options.

Determining how much house you can afford is a little more complicated than finding a monthly mortgage payment equal to your rent.

We’ll walk you through this multi-step process below so you’ll have a good idea of whether your budget is ready to include a mortgage and how big of one you can afford to take on.

How Much Can You Afford to Spend on Housing Each Month?

Determine how much of your budget you can or want to devote to housing costs every month.

Keep in mind that homeownership costs are more than just the principal and interest on your mortgage.

Owning a home requires additional costs you didn’t have to pay while you were renting, including:

- Property taxes

- Homeowner’s insurance

- Repairs

- HOA fees

Total all of these plus your mortgage payment to get your total monthly housing cost.

The 28/36 Rule

When deciding whether to approve a mortgage, most lenders follow the 28/36 rule:

- Total housing costs shouldn’t exceed 28% of your gross monthly income

- Total monthly debt payments shouldn’t be more than 36% of your gross monthly income

Let’s see how this looks for a Texan making the median monthly income [$5,052] to calculate a potential mortgage payment.

$5,052 x 28% = $1,415

Mortgage plus other housing expenses should total no more than $1,415 per month

To run the numbers for your own budget, try this Mortgage Payment Calculator.

Another metric that lenders use is to determine if you can afford mortgage payments is what your debt-to-income ratio [DTI] would be after taking on a mortgage.

This is a good barometer for lenders to see your overall financial health and make sure your finances are not overextended.

Having a higher DTI translates to a low chance of approval (unless you have a high credit score, in which case some lenders may be forgiving).

To optimize your chances at pre-approval, it’s best to keep DTI under 36%.

When figuring out how much you pay each month in debt, remember to include:

- Minimum credit card payments

- Student loans

- Auto loans

- Alimony / Child support

- Personal loans

- Mortgage payment estimate

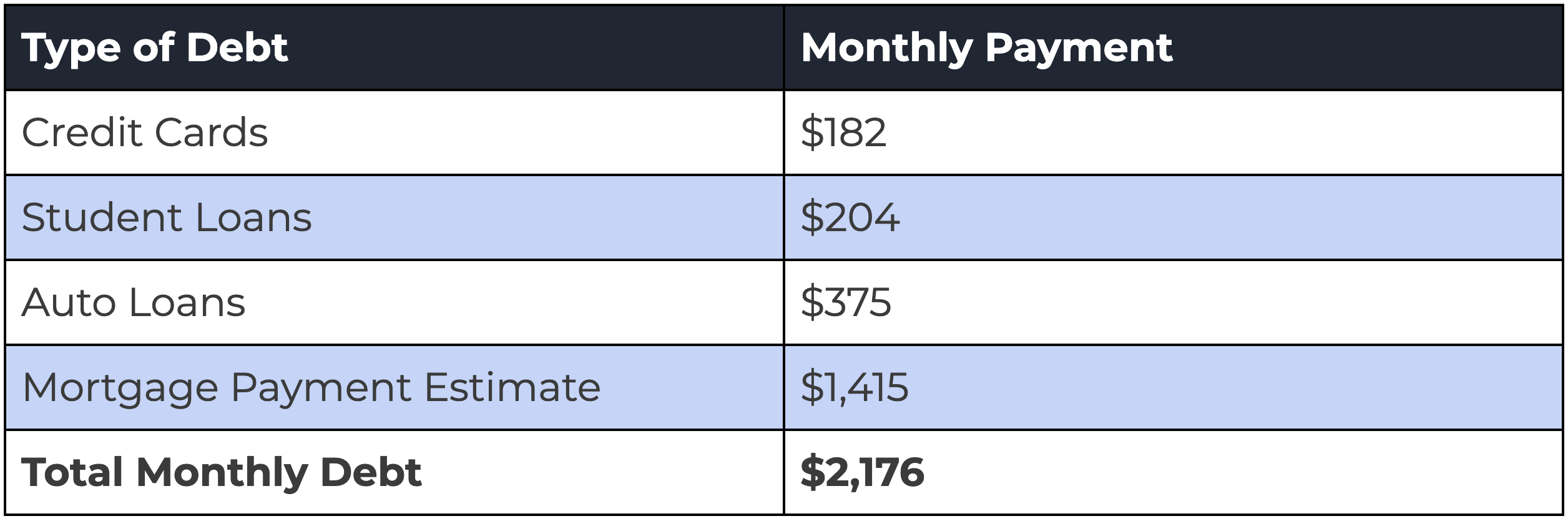

Let’s take a peek at an average Texan’s debt load to see how DTI works in action.

How To Calculate Your Debt-To-Income Ratio

To calculate your DTI, total up the monthly payment on all of your debt.

The table below provides an example and reflects the debt load of the average Texas resident.

Based on data from Chamber of Commerce, LendEDU, and AutoWise [avg. used car payment]

Add up recurring monthly debt payments and your estimated mortgage payment (don’t include down payment or closing costs here—just your monthly bill).

Then, divide by gross monthly income [before taxes].

Given that the median monthly income in Texas is $5,052, a typical DTI in the state is 43%.

$2,176 ÷ $5,052 = 43%

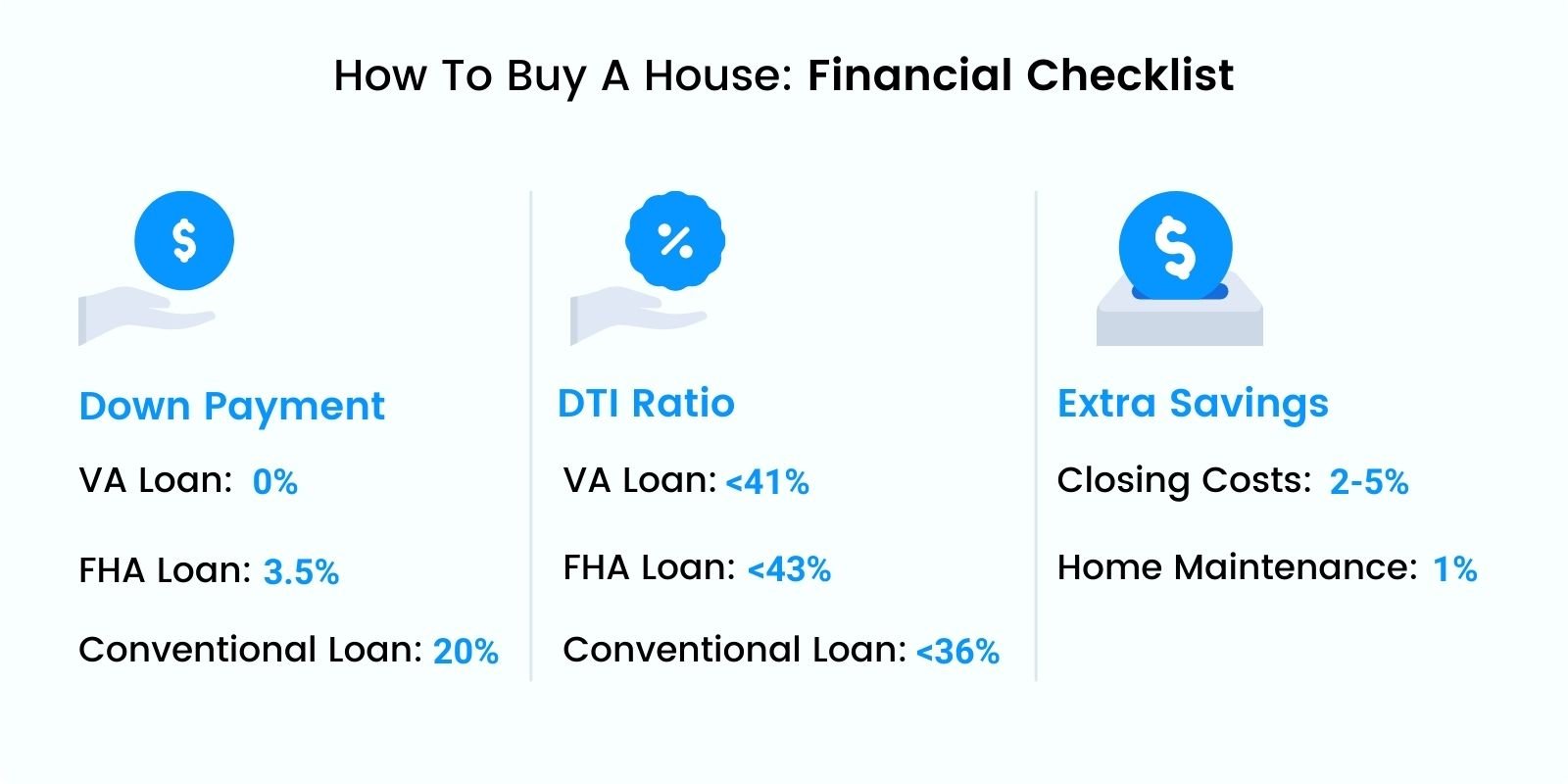

Your DTI will impact what type of mortgage you can apply for.

Most conventional loans require an after-mortgage DTI under 36%, a VA loan under 41%, and an FHA loan under 43%.

Keep in mind that these financial requirements aren’t set in stone, but know that a higher DTI means more scrutiny during the mortgage loan underwriting process.

Down Payment

Lenders won’t allow you to borrow 100% of the money you need to buy a home; they expect you to bring some cash to the table.

The portion of the money you pay for your home out of pocket is known as the down payment.

A down payment ensures that you have some skin in the game.

Opting for a small down payment is a common mistake home buyers make when shopping for a mortgage.

For example, if you put $20,000 down to buy a house, you have 20,000 reasons not to default on your mortgage.

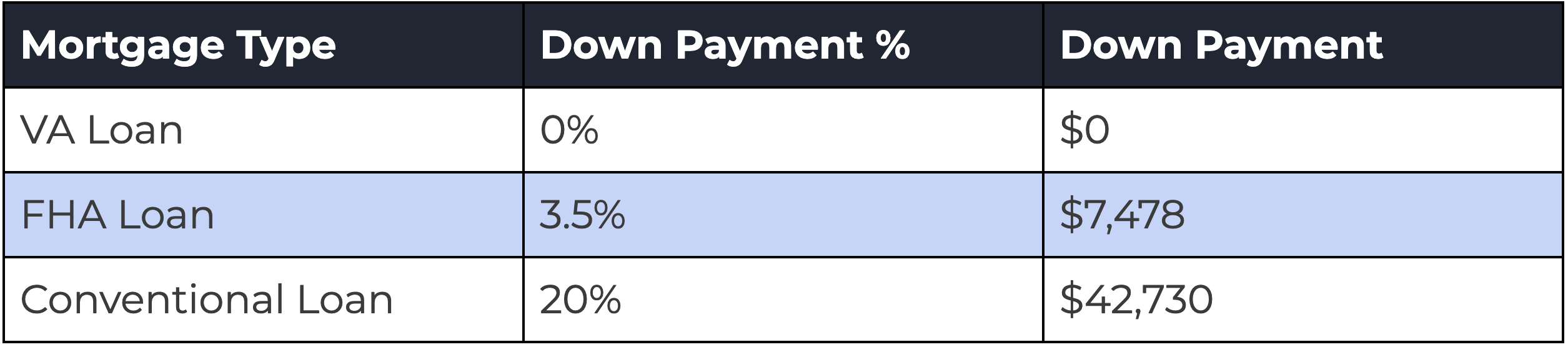

For conventional loans, down payments are around 20% of the purchase price.

VA and FHA loans have lower down payment amounts because they use other means to offset the lender’s risk [VA Funding Fee and PMI].

In Texas, the median home value is $213,652.

Using that as an example, here’s how much you’ll need to save for a down payment:

Based on home value data from Zillow

Based on home value data from Zillow

Closing Costs

Closing costs are all the charges associated with buying a house beyond the actual price.

They include things like:

- Title searches

- Title insurance

- Loan origination fees

- Document recording

- Escrow fees

- Appraisal fees

- Inspections

- Property taxes

- And more…

You can expect closing costs to be roughly 3-5% of the purchase price of the home.

Typically the buyer pays for closing costs, but sometimes sellers may pay for some or all of closing costs as a concession.

2. Get Pre-Approved for a Mortgage

Pre-approval means that a lender has reviewed your income, expenses, and credit report and has conditionally agreed to loan you a set amount of money for the mortgage.

This enables you to look for a home at or below that price level with confidence that you’ll be able to fund the deal if you put an offer in.

This also makes you much more appealing to the seller, since he or she knows you are willing and able to pay for the home.

Talking to lenders will give you a feel for the types of mortgages you may be able to qualify for.

Ask about terms, interest rates, credit score requirements, and DTI.

Speak with multiple mortgage lenders to find the best type of mortgage for your situation and the best interest rate.

Once you’re pre-approved for a mortgage, it’s imperative that your financial situation doesn’t change.

If your credit drops or you deplete your cash reserves by making a large purchase, that can derail the process and potentially keep you from closing on your house.

Compare Interest Rates

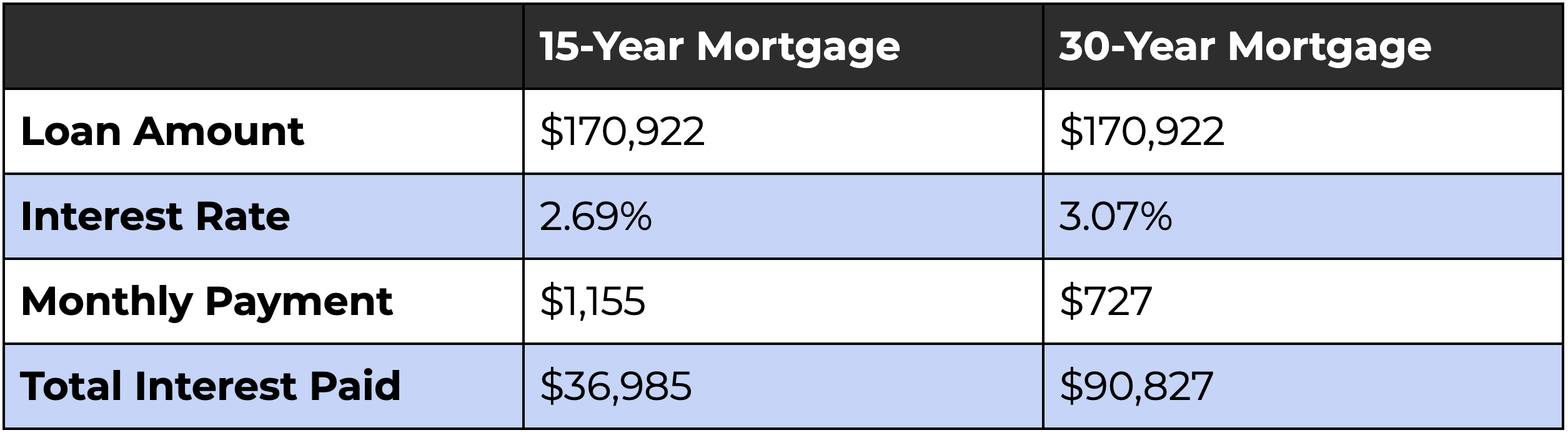

Most mortgages are written for 15, 20, or 30 years.

The length of the mortgage affects the size of your monthly payment, as well as the total interest you’ll pay over the life of the loan.

You’ll pay a higher monthly payment with a 15-year mortgage, but you’ll save quite a bit in interest.

Also, you’ll likely land a better interest rate on a shorter-term loan, since that’s less risk to the lender.

Conversely, a 30-year mortgage will require a smaller monthly payment but will cost you thousands in interest long term.

Let’s see how the numbers break down for different term loans using Texas’s median home value of $213,652 [assuming a 20% down payment].

15-Year Mortgage vs. 30-Year Mortgage

Based on home value data from Zillow and interest rates from Bankrate.com (Aug. 5, 2020)

Based on home value data from Zillow and interest rates from Bankrate.com (Aug. 5, 2020)

3. Find a Trustworthy Real Estate Buyer’s Agent in Texas

Your real estate agent will be your main ally throughout the home buying process, so it’s essential to have someone on your team that you trust.

Aside from finding and showing you houses, Realtors can also:

- Recommend other services [lawyers, lenders, and escrow companies]

- Show you what to look for when buying a house

- Help you negotiate to get a great deal

- Provide info on market conditions

- Review comps to see if a house is worth the asking price

- Help prepare offer and counteroffers

- Locate the best neighborhoods, school districts, etc.

Interview potential real estate agents about their experience with homes of a similar size and in the same area as yours.

Check referrals from websites and friends to locate a friendly, trustworthy real estate agent to represent you through the buying process.

4. Choose the Right Neighborhood

When considering where to buy a home, focus first on the one thing you can’t change about it —the location.

Choosing the right neighborhood will weigh more on your overall satisfaction than the countertops or crown molding.

When considering an area, keep the following in mind:

- Home values: The average home values of a neighborhood will help you determine if you can afford to live there. Historical trends in property appreciation will also show you if buying in the area will pay off in the future.

- Local lifestyle: A neighborhood can impact everything in your life from your daily commute to your kids’ school to where you go out to eat.

Look at a Neighborhoods Average Home Value

Do some research on the current sale prices for homes in different neighborhoods in order to begin narrowing down your options.

You can look at past home value trends to get an idea of how much your home’s value can appreciate in coming years.

Bear in mind, however, that even though many Texas metro areas have seen double-digit appreciation rates in the last few years, this hefty spike in home prices is not typical of real estate.

Modest gains of around 3-4% per year are typical.

Does the Neighborhood Meet Your Needs & Preferences?

Once you have a list of neighborhoods you can afford and that are good places to invest, you’ll need to evaluate how well each area meets your personal needs and preferences.

To finalize your list of target areas, look into neighborhood features like:

- School districts

- Restaurants

- Amenities (pools, parks, theatres)

- Crime rates

- Walkability

- Transportation options

- Proximity to work

Go over your list of priorities with your real estate agent so you can determine how much of the list is realistic for your budget.

When you share what’s important to you with your agent, he or she can be on the lookout for houses that fit your criteria.

5. Start House Hunting in Texas

While it can be a bit time-consuming and stressful, the thrill of house hunting is the most fun part of the buying process.

Sadly, however, the fun has to end eventually, and you’ll have to make a decision about which home is best for you and your family.

A common mistake of first-time homebuyers is to hold out for the “perfect” home.

Remember, even if you’re buying a newly constructed home, not everything about it will be perfect.

You’ll have to decide which of your priorities are non-negotiable and which are just nice to have.

While the internet is a great place to start browsing for your dream home, don’t underestimate the wealth of information you’ll get at an open house or an in-person tour.

Even if you have to take a virtual tour, your real estate agent can help you notice flaws you may not have noticed otherwise, as well as unexpected benefits to the layout or amenities of the home you’re touring.

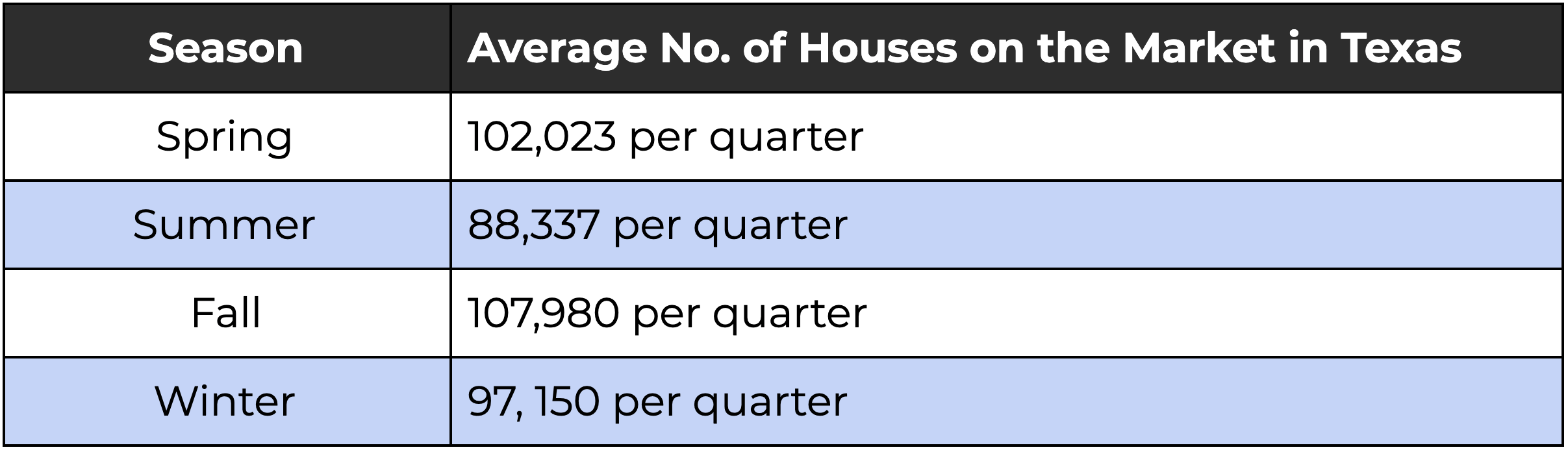

When is The Best Time to Buy a House in Texas?

The best time to buy a house is several months before you need to move, as the home buying process can be a lengthy one.

Beyond that, the seasons and even the weather can have a bearing on the housing market.

Many people want to avoid switching their children from one school to another in the middle of the school year, so at the end of school in late spring or in the early fall are both popular times for home sales.

Additionally, selling property (especially homes with acreage) will be much easier when the weather is not cold and mucky in winter or baking hot in the Texas summer.

Most people don’t want the trouble of buying or selling a house around the holidays.

Texas Housing Inventory by Season

Based on 2019 data from Realtor.com

Based on 2019 data from Realtor.com

6. Submit an Offer

This is where it really pays to have the experience of a real estate agent on your side.

Your realtor can give you tailored, expert advice on how much to offer for a particular home.

An offer includes more than just the proposed home’s selling price.

Include “terms” such as how soon you need to be in the house, and “contingencies” such as whether you need to sell an existing house first.

Here are some good things to know so you can submit prime offers:

- Move fast: How quickly are homes going off the market? Don’t wait too long to make an offer. In 2020, homes spent an average of just 25 days on market before going under contract.

- Sweeten the deal: Sometimes a higher price isn’t your best option for getting a seller to accept your offer. You can write in different terms — like no contingencies or a quicker closing date— to create a deal that works for you and the seller.

How To Negotiate Your Real Estate Deal

Sellers don’t accept offers based on price alone, so offering a higher price is not always a winning play.

Depending on the state of the real estate market, you can make compromises to sweeten the deal for both you and the seller.

Seller Concessions

Pros: Closing costs included in mortgage for the buyer, higher sale price for the seller

Cons: Higher sales tax/agent fees for buyer and/or seller

Repair Credits

Pros: Control over repairs for the buyer, no risk of repairs going over budget for the seller

Cons: Repair credit may not cover the actual price of repairs for the buyer

No Inspection Contingencies

Pros: Faster closing for buyer and seller, less chance of the deal falling through for seller

Cons: Potential for serious flaws of the property to go undetected until after closing for the buyer

Letter to the Seller

Pros: Allows the buyer to stand out from other offers, assures the seller that the home will be in good hands

Cons: None

Talk with your real estate agent on which ones (if any) make sense to include in your offer.

You may want to check out our list of real estate negotiation tips for buyers.

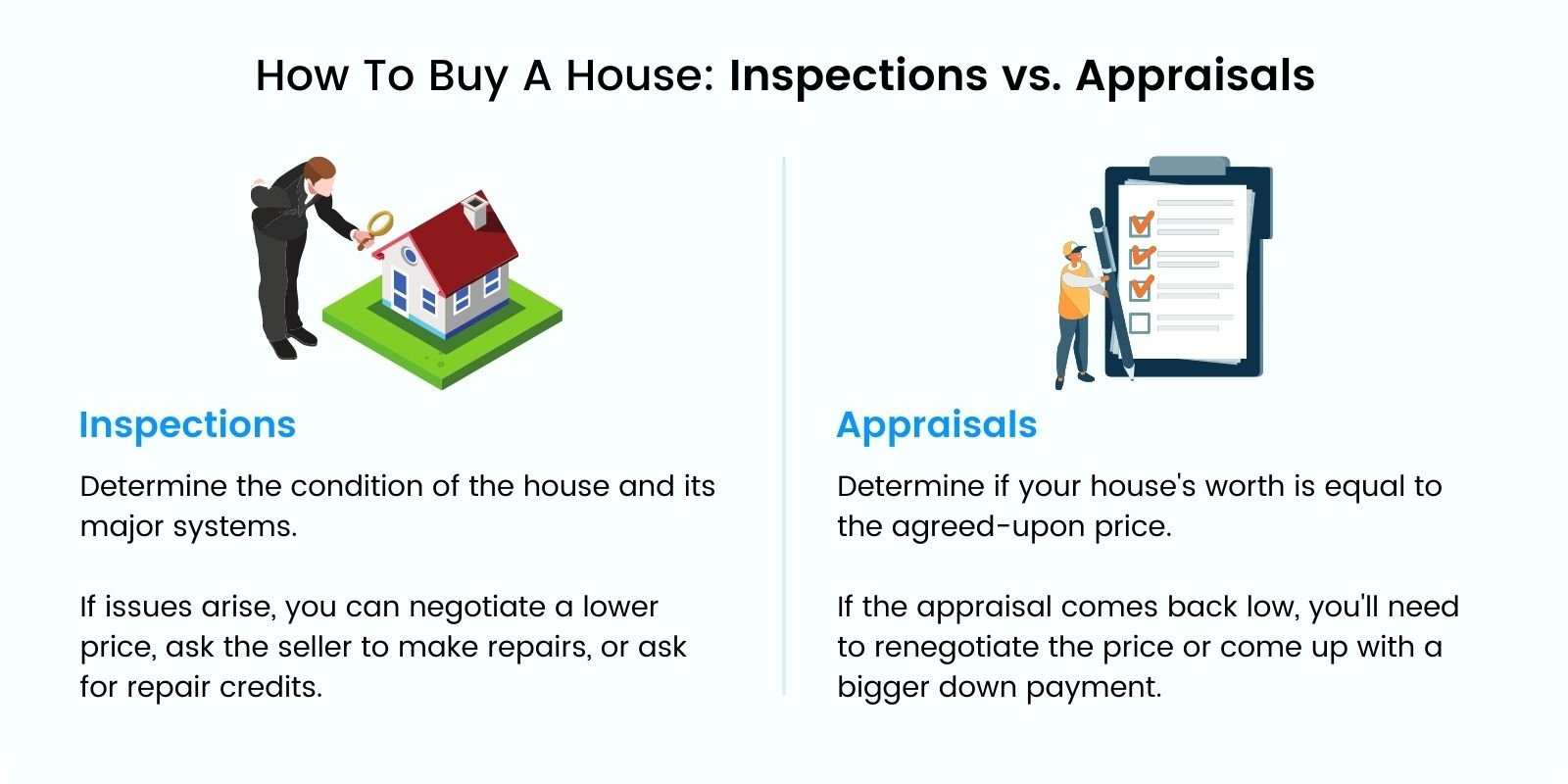

7. Get a Home Inspection & Appraisal

When buying a home, the last thing you want is an unpleasant surprise like termites, flood damage, an out-of-date electrical system, or other liabilities lurking behind the drywall.

The best way to avoid these problems (during the home buying process and after you sign on the dotted line) is to get an inspection and an appraisal.

Creating a contingency clause for these two items in your offer gives you the option to return to the negotiating table if any issues come up.

This is especially true if you’re buying a fixer-upper house and don’t want any major issues ruining your plans.

Inspections

Inspections give you peace of mind about the condition of the property.

You should always hire a licensed inspector and make sure they check out each part of the property.

The inspector should pay close attention to the following areas, as these things may need to be repaired for you to qualify for certain types of mortgages:

- Roof

- Foundation

- Electrical system

- HVAC system

- Plumbing

We’ve compiled a list of the 13 most common home inspection issues for you to review.

If the home has a septic system, it’s also a good idea to pay for a septic inspection that scopes out the system with cameras to look for any potential issues.

Texas Specific Inspections

Aside from a general inspection, we also recommend buyers have the following inspections and testing done before closing on a home:

Radon Testing: While it’s not required by law, we strongly recommend that homes are tested for radon—a colorless, odorless gas that can cause lung cancer. If the seller hasn’t had the house’s radon levels tested recently, consider having it tested before closing on the home.

Termite Inspection: If you’re applying for a VA or FHA loan, you’ll most likely be required to have a termite and pest inspection in Texas.

Get an Appraisal

Naturally, the lender wants to ensure that the home is worth what you’ve agreed to pay for it.

An appraiser verifies that the contract price is fair for the buyer, seller, and lender.

Here’s a broad overview of the appraisal process.

- A licensed appraiser comes to the home and does a walk-through.

- They will note the appearance, amenities, and condition of the property.

- The appraiser looks at what comps (homes of similar square footage and condition) in the neighborhood recently sold for.

- The appraiser prints out a report of their observations, as well as recommendations for any renovations or upgrades that may add value to the home.

8. Final Walkthrough and Closing on Your New Home

It’s a good idea to take a final walkthrough of your home to double-check for any problems that you or the inspector might have missed.

Final Walkthrough of the Property

When you take a final walkthrough, look for wear and tear that may have occurred since you first saw the home.

Also, check for things that might not be severe problems but would interrupt your everyday use of the home.

Here are a few key places to check before you head to the closing table:

- Inspect ceilings, walls, and floors for cracks, chipped or peeling paint, etc.

- Test every light switch, electrical outlet, and appliance

- Run the water to look for leaks, adequate pressure, and check the temperature

- Flush all toilets

- Ensure there are working keys for all doors, including garage door openers or smart lock technology

- Check heating and air conditioning systems

- Open and close all windows to ensure that they lock and aren’t drafty

Closing On Your New Home in Texas

In Texas, a real estate attorney is required to be part of every home sale.

While your agent can make recommendations for an attorney, remember you get to make the final decision.

Interview real estate lawyers before hiring them to make sure they have the experience you need.

During the closing, make sure you understand each of the documents you are signing, like the closing disclosure form.

Your home will likely be one of the largest purchases you ever make, so you should feel confident in knowing what obligations you are taking on.

Don’t feel foolish asking your attorney or real estate agent what something means or why it’s necessary — that’s why they’re there!

Key Takeaways of Buying a House in Texas

Buying a house is an involved and time-consuming process, but it doesn’t have to be overwhelming.

Below is a list of the key takeaways on how to buy a house in texas.

How To Buy A House In Texas Step-By-Step

- Evaluate Your Financial Situation. You’ll need a solid credit score, a healthy debt-to-income ratio, an appropriate down payment, and enough savings to cover closing costs and homeownership expenses.

- Get Pre-Approved for a Mortgage. Most sellers won’t show their home to buyers who aren’t pre-approved. Do your research and find a lender that offers the best interest rates and terms and that will ensure the deal closes.

- Find a Trustworthy Real Estate Agent. A great agent will have experience in your area and price range. They’ll also be able to help you throughout the home-buying process.

- Choose the Right Neighborhood. Find an area that fits your lifestyle and is a good investment for the future.

- Start House Hunting in Texas. Compare your options and make sure you understand your local market and what its condition means for your choices.

- Submit an Offer. Price isn’t the only factor sellers consider. Talk with your Realtor so you can make a competitive offer that benefits you and the seller.

- Get a Home Inspection and Appraisal. Inspections and appraisals give you and your lender peace of mind about the purchase, but be prepared for more negotiating if anything unexpected comes up.

- Final Walkthrough and Closing. Take the time to check the entire house closely. Once you officially close on the house, it’s all yours!

If you know what steps to prepare for and have a trusted and reliable real estate agent to represent your interests throughout the buying process, you’ll find the perfect home in your price range.

To find a reliable real estate agent, look no further than the oldest and most trusted real estate agency in Fort Worth, TX: Helen Painter Group Realtors.

Helen Painter’s agents have been representing buyers and sellers in Fort Worth since 1958.

If you’re looking at buying a home, give us a call at (817) 923-7321 or sign up online for a free consultation.