A home is one of the most expensive purchases that most people ever make.

Most people don’t have hundreds of thousands of dollars in cash lying around to buy a house, so they take out loans called mortgages to purchase a home.

Mortgages come in dozens of varieties, each with its own lingo, qualifying criteria, and fine print.

If you’re a first-time homebuyer or you’re looking for a home loan that might better meet your financial needs, read on.

This article covers the basics of what a mortgage is, how to qualify for one, the most common types of mortgages, as well as some basic terminology you’ll need to understand before purchasing a home and enjoying the benefits of homeownership.

What is a Mortgage?

A mortgage is a loan to buy a house that you repay over a set number of years.

While the length of mortgages varies, 30 years is the most common.

(This explains the tie between the Latin roots ‘mort’ and ‘gage,’ which mean ‘death’ and ‘pledge.’ Fitting, no?)

As part of the mortgage agreement, you put up the house as collateral, meaning the bank can take the house if you don’t make your mortgage payments.

Mortgages typically require a down payment—a percentage of the purchase price that the borrower must bring to the table in cash before the loan is written.

Lenders are judicious on whom they approve for mortgages.

If you’re looking for a lender to apply for a loan, you should take a look at our guide for homebuyers on finding a mortgage lender.

Some of the qualifying factors for mortgage approval are:

Income

Lenders want to see that you have a history of steady and sufficient income so you can make your agreed-upon mortgage payments each month.

The bank or lending institution will typically base their decision on the last two years of income.

They verify that income with W-2s, tax return documents, and/or pay stubs.

If you are self-employed, you’ll need a lot more documentation.

Lenders will look at your personal tax returns, business tax returns, profit and loss statements, business license, balance sheets, and more.

Credit Score

Your credit score reflects how much debt you have and how good you are at managing it, so naturally, an institution looking at lending you thousands of dollars is interested in your score.

Lenders take your credit score into consideration when deciding whether or not to consider you for a mortgage.

A lower score (<600) may not eliminate you from a mortgage completely, but it will narrow the field on what types of mortgages you qualify for.

A low credit score signals greater risk for the bank, so it translates to a higher interest rate on your loan.

Candidates with scores above 700 enjoy lower interest rates and will find qualifying for a mortgage much easier than those with lower credit scores.

Debt-To-Income Ratio

Debt-to-income [DTI] ratio takes the total of your monthly debt payments (student loans, credit cards, car notes, etc.) and divides it against your gross monthly income.

Lenders look at this ratio to tell whether you’ve already taken on too much debt or you have the bandwidth to handle a mortgage payment.

The lower your DTI, the better your chances of qualifying for a mortgage.

Lenders like to see DTI ratios stay below 36%.

The absolute highest your DTI can be and still qualify for a mortgage is 43%.

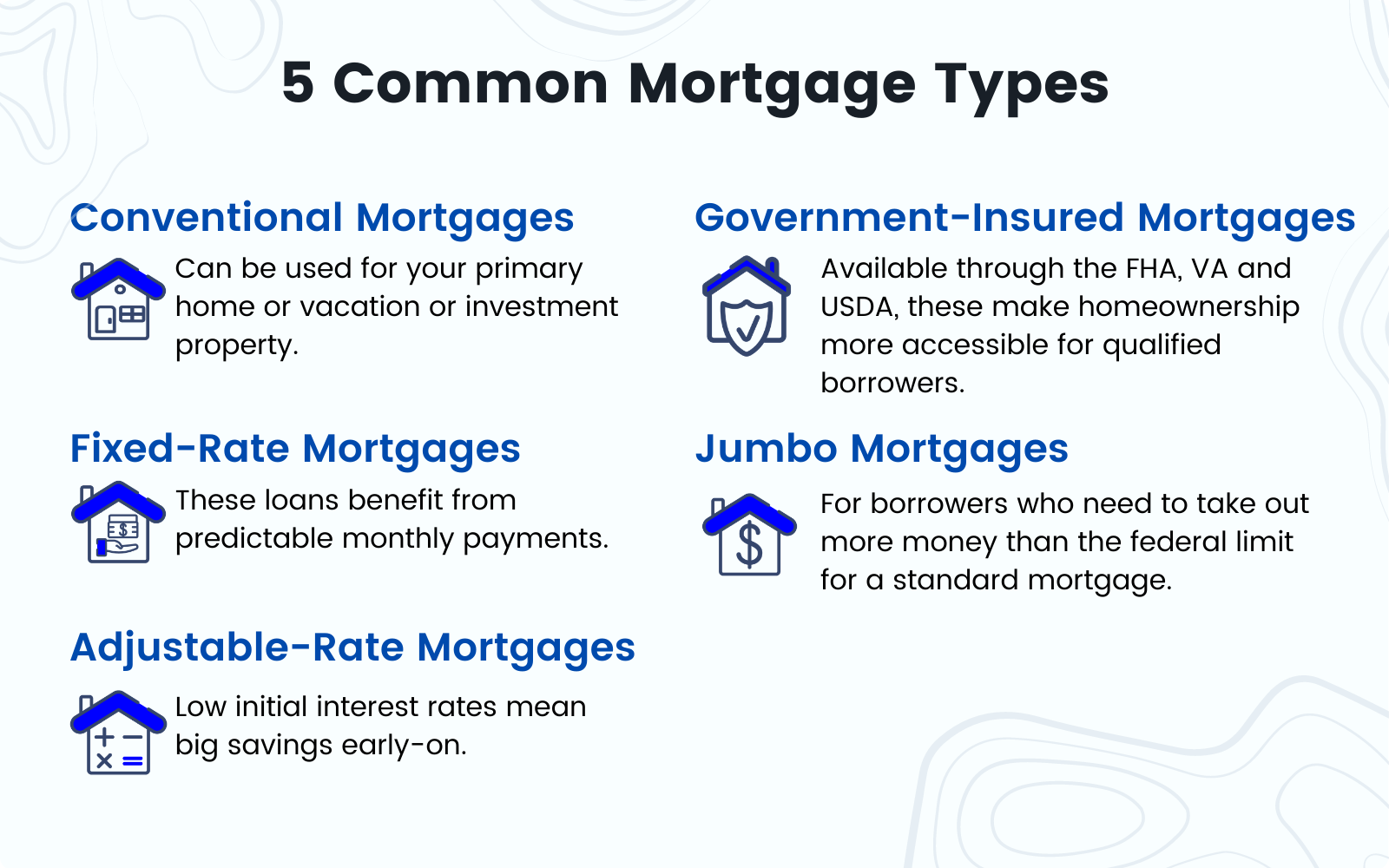

Types of Mortgages

Mortgages come in all shapes in sizes.

Each different type will have different perks and drawbacks.

Interest rate, length, and qualifying criteria will vary for each variety of mortgage, so talk with your lender to see which type suits your situation best.

We’ve outlined the most common types of mortgages below.

Conventional Mortgages

Also called a traditional mortgage, a conventional mortgage is an agreement between you and the bank and is not insured by the government.

Because of this, lenders require a larger down payment than government-backed loans to make sure you have something to lose if you stop making your mortgage payments.

Down payments can be as little as 3% for a conventional mortgage but are generally closer to 20%.

Most conventional mortgages meet the guidelines for the down payment and income set out by the Federal Housing Finance Administration, though they allow for more flexibility on terms, interest rates, and property types than other mortgages do.

Pros of Conventional Mortgages

- More applications. Conventional mortgages can be used for a primary residence as well as a second home or investment property.

- Better PMI arrangement. If you put less than a 20% down payment, PMI on conventional loans is 0.5 – 1% of the loan amount per year. FHA loans require an upfront mortgage insurance fee, as well as monthly premiums.

- More lenient appraisal criteria. With government-backed mortgages, homes must meet strict home appraisal guidelines. Conventional loans bypass these requirements.

- Flexible terms. Conventional mortgages can be written for terms of 10, 15, 20, or 30 years.

Cons of Conventional Mortgages

- Higher credit score requirement. Lenders typically require a 620 credit score for conventional loans, though they can raise that minimum. The best interest rates go to borrowers with scores above 740.

- Larger down payment. The hefty upfront cash required for a conventional mortgage can be a deterrent for some buyers. Not putting a large enough down payment down is a common mistake of first-time homebuyers.

FHA Loans

The Federal Housing Administration was created in the 1930s to help more Americans reach homeownership after the Great Depression.

The FHA doesn’t actually issue any loans.

Rather, the FHA backs loans to people with lower credit scores and smaller down payments than conventional loans allow for, enabling lenders to take on more risk.

The favorable terms and easy qualifications of FHA loans make them a popular choice for many homebuyers.

Pros of FHA Loans

- Low down payment. FHA loans require only 3.5% down (10% if your credit score is between 500 and 579).

- Flexible down payment options. With FHA loans, you can use a gift from a trust or relative as a down payment. FHA loans also have down payment assistance programs available.

- Very liberal credit score requirements. As long as your credit score is above 500, you haven’t had any recent bankruptcies or foreclosures, and you aren’t delinquent on any student loans or federal income taxes, you may qualify for an FHA loan.

Cons of FHA Loans

- Less flexible terms. Pick your flavor: a 15-year mortgage or a 30-year mortgage. These are your only options.

- Minimum Property Standards. If you are hoping to purchase a fixer-upper as your home, you’ll probably need a different type of mortgage. FHA loans can only be issued on properties that meet the U.S. Housing and Urban Development (HUD) standards. Things like cracked flooring, heaving sidewalks, or damaged sheetrock must be repaired before the home can qualify for an FHA loan.

- Work history. Rather than relying solely on a credit report, FHA lenders factor in your work history in deciding whether to lend to you. This can be a problem if you have changed jobs or been unemployed recently. FHA lenders require two years of steady income, preferably from the same job.

- Limits on price. In most areas, FHA loans can only be issued for up to $356,362 (in high-cost areas, this limit bumps up to $822,375).

- Homes must be owner-occupied. FHA loans are designed for primary residences, though you can purchase a dwelling with up to four units with an FHA loan, provided that you occupy at least one of those units.

- PMI. FHA loans require both an upfront mortgage premium, which is 1.75% of the loan amount (due at closing or rolled into the loan), and an annual payment that is 0.8% to 1.05% of the remaining loan balance. PMI stays with FHA loans until they are paid off or refinanced.

VA Loans

If you or your spouse is actively serving in the military or you are a veteran, you have a wonderful mortgage tool available to you — a VA loan.

These are low-cost mortgages for those who serve in the military and they come with several unique benefits.

Before you can get a VA loan, you must prove your duty or discharge status with a Certificate of Eligibility (COE).

Check the Department of Veterans’ Affairs website to check the qualifications.

Similar to FHA loans, VA loans are backed by the government (though it’s the Department of Veterans Affairs rather than the Federal Housing Administration), allowing banks to lend to borrowers with lower credit scores with a smaller down payment than they would otherwise.

Pros of VA Loans

- No down payment. Yes, you read that right. You may be able to get into a VA for 0% down, though there are other fees.

- Very low-interest rates. The Interest rates on VA loans are often lower than comparable FHA or conventional loans.

- No PMI. Even if you don’t have 20% equity in your home, VA loans do not require PMI. This can save you 0.5% – 1% per year!

- Lenient DTI ratio requirements. Of all the different types of mortgages, VA loans have the highest allowable DTI ratio—50% for adjustable-rate mortgages and 60% for fixed-rate mortgages.

- 100% loan-to-value allowance. Most mortgages require you to have some equity in the property, even if it’s a small amount. VA loans do not require this, so you can take out a loan on 100% of the purchase price of a property, sometimes more if it needs home improvements. This is also true for cash-out refinances—you can cash out 100% of the equity you have in the property.

Cons of VA Loans

- Only available to qualified veterans/spouses. The VA has very specific requirements for military members or their spouses to qualify for VA loans (length of service, honorable discharge, etc.). Check here to see if you qualify.

- Funding fee. VA loans come with a one-time 1.4% – 3.6% funding fee that offsets the cost of the VA loan program to taxpayers. This can be paid upfront with closing costs or rolled into the loan and paid off over time.

- Potential to end up “underwater.” Because VA loans allow you to borrow up to (and in some cases above) 100% of the home’s value, if the real estate market dips, you can easily end up “underwater”—owing more on your home than it’s worth.

USDA Loans

The VA and FHA aren’t the only government bodies to guarantee mortgages—the U.S. Department of Agriculture backs loans as well.

USDA loans are designed for low- or middle-income buyers who purchase homes in designated rural areas.

To qualify for a USDA loan, you must be unable to secure a mortgage from traditional sources and your income must fall within certain limits.

The USDA also issues direct loans for low-income applicants, as well as home improvement loans and grants.

Pros of USDA Loans

- No down payment. Like VA loans, USDA loans do not require a down payment. You can finance 100% of the price of the loan, as well as additional money for closing costs and repairs.

- New construction.

- No cash reserves required. Some lenders require you to have enough cash to cover a few months of mortgage payments

Cons of USDA Loans

- Only good for rural properties. To qualify for a USDA loan, your property must be located in a rural area as designated by the USDA. Many of these areas include small towns, as well as areas just outside major metropolises. The USDA website will help you determine whether a property meets the geographic limits for a USDA mortgage.

- Square footage limits. USDA loans are good for homes of 2,000 square feet or less, though there is a little wiggle room.

- 30-year term only. These loans only have one option for duration—30 years.

- Single-family, primary residence only. Duplexes and other multi-unit properties are ineligible for USDA loans, nor are investment properties. Since they are designed to help low-income, rural buyers, USDA loans only work for single-family family houses that are the buyer’s primary residence.

- Income limits. You must not exceed the income guidelines for your area in order to qualify for a USDA loan. Typically these max out at 115% of the median income for your region.

Jumbo Loans

As you might have guessed from the name, jumbo loans are mortgages that are exceptionally large.

For properties worth more than $548,250, you’ll need a jumbo loan.

Also called non-conforming loans, these loans exceed the limits that Fannie Mae and Freddie Mac (government-created entities that buy mortgage loans) will insure.

Because they aren’t backed by the government, jumbo loans represent more risk to the banks that issue them than other types of mortgages, so they are much stricter with their requirements on income, cash reserves, and credit score.

Pros of Jumbo Loans

- No price limits. The only limit on the amount of a jumbo loan is the amount the bank is willing and able to loan you.

Cons of Jumbo Loans

- High-interest rates. Because jumbo loans are not insured, the bank requires a higher interest rate to offset the increased risk.

- High down payment. The bank will invest a lot of capital in a jumbo loan, so they want to make sure you are willing to invest your cash as well. Plan on making at least a 15% down payment on a jumbo loan, if not more.

- High-income requirements. The lender wants to make sure you can keep up with a high monthly mortgage payment, so they want to see an income level to match the price of the jumbo loan.

- Cash reserve requirement. If you’re taking out a jumbo loan, lenders will expect you to have enough cash or liquid assets to cover about six months’ worth of mortgage payments.

- High credit criteria. Make sure your credit score is at least in the high 600s before applying for a jumbo loan. Most lenders like to see a very high credit score (700 and above) and a low DTI to make sure the borrower can manage a hefty debt payment and isn’t already overextended.

What Costs Are Included in a Mortgage Payment?

While you’ll only pay one bill for your mortgage each month, it is broken down into four parts: principal, interest, taxes, and insurance.

You may hear this referred to as a PITI (pronounced ‘pity’) payment.

We’ll dive into each of these components below.

Principal

The principal is the original amount you owe.

For each payment to the bank, only a portion pays down the total of your principal; the rest pays for the interest.

In the meantime, the rest of the principal balance continues to accrue interest.

As you make more payments and the total of the principal goes down, it generates less interest, devoting more of your monthly payment to eliminating your mortgage.

Interest

Interest is the cost of borrowing money.

It is calculated as a percent of the principal you owe.

In the early years of your mortgage, interest will be the heftiest portion of your monthly payment.

Mortgages can be written to have two different types of interest rates: fixed and adjustable.

Fixed-Rate Mortgages

In fixed-rate mortgages, there are no surprises.

The interest rate stays the same over the life of the loan.

This is great if you snag a low-interest rate when you take out the loan, but if you want to take advantage of dropping interest rates, you won’t be able to do so without refinancing.

Adjustable-Rate Mortgages

These mortgages (often called ARMs) usually lock in a low-interest rate for the first few years of the loan, after which the rate can adjust up or down based on the lender’s going rate.

The initial payment amounts in adjustable-rate mortgages typically beat out those of their fixed-rate counterparts, so they can be useful for people with the discipline to use the extra cash flow to pay down principal or people who plan to pay off the mortgage in a few years.

The mortgage usually comes with a cap on how much your payment and the interest rate can go up, but because your finances and the state of the economy can change at any given time, ARMs are inherently riskier.

In today’s environment of perpetually low-interest rates, ARMs do not provide the same advantages they once did.

Taxes

In addition to the principal and interest payments you make to the lender, you’ll also be responsible for property taxes each year.

These are due regardless of whether or not you have a mortgage on your home, though you may qualify for a homestead exemption or other discount on your taxes depending on how you use the property.

These vary from state to state.

While no one likes to pay property taxes, they fund a lot of things, such as schools, roads, fire departments, etc.

Insurance

While you have a mortgage on your home, your lender will require you to carry homeowner’s insurance.

As the primary lienholder, the bank wants to protect its investment in case disaster strikes.

This benefits the homeowner too since most people don’t have a sufficient cash store to take care of major repairs, such as hail damage to a roof or a flooding basement.

Homeowner’s insurance will cover most of these major catastrophes.

PMI [Private Mortgage Insurance]

In addition to homeowners insurance, borrowers that make a down payment of less than 20% will be required to carry private mortgage insurance (PMI).

Rather than insuring the home itself, PMI insures the bank against the possibility of you defaulting on your mortgage.

Some mortgages allow you to stop paying PMI once the equity in your property reaches the 20% mark (though you’ll have to formally request this); for others, you have to refinance to get PMI requirements removed.

How Do I Calculate My Mortgage Payments?

You can calculate your monthly mortgage payments yourself.

This will help in determining how much home you can afford.

The numbers you’ll need for your mortgage calculation are:

- P = The principal (total loan amount, not including the down payment)

- I = Your mortgage’s interest rate (use the monthly interest rate for the equation below, but online calculators generally use the annual rate)

- How many monthly payments you’ll make to pay the loan off (30 years x 12 or 15 years x 12)

This is what the equation looks like for a fixed-rate loan:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

If you would rather plug in the numbers and let the internet calculate your mortgage payments for you, try our free online mortgage calculator tool.

Mortgage FAQs

Mortgages can be extremely complex, and there are a lot of unique terms and concepts to understand.

We have answered some frequently asked questions below to demystify the mortgage loan process a bit for you.

If you’re on the other side of the table and selling your home, you should check out our top home seller questions.

What is the “Promissory Note”?

This is one of many official documents you sign when you enter into a mortgage.

By signing one, you agree to pay the lender back the set amount of money you borrowed to buy your home.

It’s a lot like an official IOU note.

It contains all the terms and agreements regarding the loan, as well as the interest rate, principal amount, and date of maturity.

Should I get a Mortgage Pre-Qualification or Pre-Approval?

Mortgage pre-qualification is generally the first step in the home buying process.

You can often get pre-qualified online or over the phone in just a few minutes.

A mortgage pre-qualification will give you a ballpark estimate of how much you may qualify for based on the financial information provided.

Once you have a mortgage pre-qualification, you’ll have an idea of the price range you should be looking for houses in.

There is a big difference between mortgage pre-approval and pre-qualification.

Not understanding this difference is a common mortgage shopping mistake that can delay the home-buying process.

When you’re ready to put in offers, then seek a Mortgage Pre-Approval.

Mortgage pre-approval is a much more involved process than pre-qualification.

You’ll have to complete an official mortgage application and supply the lender with all the necessary documentation to substantiate your financial situation.

The lender will then offer pre-approval up to a specified amount.

To learn more, check out: “Mortgage Pre-Qualification vs. Pre-Approval: What’s The Difference?”

What is a Closing Disclosure Form?

The Closing Disclosure document is a five-page, detailed summary of the terms, interest rate, monthly payment amount, and closing costs of your loan.

By law, your lender must give you this form at least three days prior to closing so you can review each item.

It’s kind of like a final check in the home buying process.

The Closing Disclosure Form can be overwhelming, especially if you don’t know what to look out for.

Signing the Closing Disclosure document is the final green light before closing.

The closing process officially begins your mortgage (if you have one) and transfers ownership of the house to your name.

What Are Closing Costs?

Closing costs is a general term that includes all the fees, expenses, taxes, and other charges associated with drafting and closing on a mortgage loan.

Some of these are regulated by the government, and others are charged by the lender, real estate attorney, or title company.

These charges vary based on the type of loan, the location, age, and size of your home, and other factors.

Paying closing costs is part of the real estate closing process.

When do Mortgage Payments Start?

Depending on the closing date and the policy of your lender, your first mortgage payment may not be due for almost two months after closing!

Typically, lenders add 30 days after your closing date, and your first mortgage payment will be due on the first day of the following month.

For example, if your loan closes on April 8th, your first mortgage payment won’t be due until June 1st.

This offers a nice reprieve to your bank account after forking over a down payment and closing costs.

What are Mortgage Interest Rates?

The interest rate on your mortgage is essentially the price you pay for borrowing money.

Interest is calculated as a percentage of the total loan amount.

The percentage of interest may seem small, but when you multiply it over thousands of dollars and 30 years, interest can cost you as much or more as the property itself.

Ideally, you want to pay as little interest as possible.

You can do this by making a large down payment, paying extra on the principal portion of your loan each month, and/or qualifying for a loan with a low-interest rate.

Mortgage interest rates vary between lenders and candidates, with the best rates going to those borrowers that post the least risk (i.e., the ones with high down payments, shorter loan terms, and high credit scores).

Interest rates fluctuate according to external economic forces as well, such as the health of the economy in general, inflation, the Federal Reserve’s monetary policy, and the current condition of the housing market.

How Much Should I Put Down as a Down Payment?

This depends largely on the type of mortgage you have, as well as your personal financial situation.

A lower down payment may allow you to get into a mortgage more quickly since you won’t have to save up as much money.

However, more money down will make for a smaller monthly payment.

A higher down payment will also save you a substantial amount in interest over the life of your loan.

Wrapping Up Mortgages 101

Regardless of the size, location, or type of home you want to purchase, there’s a mortgage to fit your situation.

Working with an experienced realtor can make the mortgage and home buying process much smoother than it would be navigating on your own.

An experienced agent will help you hone in on a property in the best neighborhood for your family with all the features you need.

Additionally, a seasoned real estate agent can recommend the local banks and lending institutions with the best mortgage rates and terms for your financial situation.

To find a trustworthy and reliable real estate agent, look no further than the oldest Real Estate Agency in Fort Worth, TX: Helen Painter Group Realtors.

Helen Painter’s agents have been representing buyers and sellers in Fort Worth since 1958.

If you’re looking to take out a mortgage to buy a home, start with a free consultation from the most trusted real estate agency in Texas!