Navigating the journey to homeownership is an exhilarating yet intricate process filled with various steps and considerations.

Among these critical steps is the often mysterious world of mortgage underwriting.

If you’ve ever wondered what happens after you submit your mortgage application, you’re in the right place.

In this comprehensive blog post, we’ll dive deep into the mortgage underwriting process.

We’ll shed light on what it is, what underwriters do, what’s evaluated during underwriting, and the steps involved.

Moreover, we’ll explore the burning question on every homebuyer’s mind: How long does underwriting take?

To ensure a smooth underwriting process, we’ll share valuable tips and insights to help you sail through this critical phase on your path to homeownership.

So, let’s dive into the world of mortgage underwriting, and help your dream of owning a home take its final steps toward reality.

What is Mortgage Underwriting?

Mortgage underwriting is the process by which a lender determines whether a borrower is eligible for a mortgage loan. The underwriter will review the borrower’s credit history, income, debts, and assets to assess the risk of lending money to the borrower.

The underwriting process typically begins with the borrower submitting a loan application. The application will include information about the borrower’s income, debts, assets, and credit history. The lender will also order a credit report and an appraisal of the property that the borrower is seeking to purchase.

The underwriter will review the borrower’s application and supporting documentation, This is to determine the borrower’s debt-to-income ratio, credit score, and other factors that affect the risk of lending money to the borrower. The underwriter will also consider the value of the property that the borrower is seeking to purchase and the amount of the loan that the borrower is requesting.

Based on the information gathered during the underwriting process, the underwriter will make a decision about whether to approve or deny the loan application. If the loan is approved, the lender will issue a commitment letter to the borrower. The commitment letter will outline the terms of the loan, including the interest rate, loan amount, and repayment period.

What Does an Underwriter Do?

Mortgage underwriters are responsible for assessing loan applications to determine approval. They work for a lender and evaluate the borrower’s financial situation and level of risk. Underwriters analyze income, assets, credit history, and home appraisal to make approval decisions, playing a vital role in the mortgage loan process.

They collaborate with Loan Officers to gather required paperwork and information for assessing the borrower’s risk level. Additionally, Loan Officers assist in ensuring all necessary documentation is submitted for a smooth process.

Key duties of underwriters include the following:

- Assessing the Home’s Value: An appraisal is used to determine the value of the home you want to buy in comparison to the seller’s asking price, ensuring that you are not paying more than the home is worth. The underwriter reviews the appraisal to confirm that the home’s actual value aligns with the loan amount, reducing the lender’s risk and protecting the buyer from overpaying.

- Evaluating Your Credit History: Lenders rely on your credit history to assess your eligibility and approval for a loan. They consider not only your credit score, but also your current open accounts, late payments, bankruptcies, and credit utilization to gauge your financial habits and history of debt repayment.

- Confirming Income & Employment: Lenders prefer to see a stable employment history of at least two years in the same position or field before approving a home loan. This demonstrates a reliable source of income to support your monthly mortgage payments. Additionally, they verify that your stated income on the application aligns with your actual earnings to ensure loan repayment ability.

- Assessing Down Payment & Savings: Before loan approval, the underwriter checks that you have sufficient funds for the property’s down payment and reviews your savings to cover additional expenses like closing costs. Some loans, such as VA loans for eligible veterans and active-duty service members, may not require a down payment, in which case the underwriter does not verify this specific requirement.

Ultimately, underwriters determine loan approval, making it important to facilitate the process by providing timely and accurate documentation after making an offer on a home.

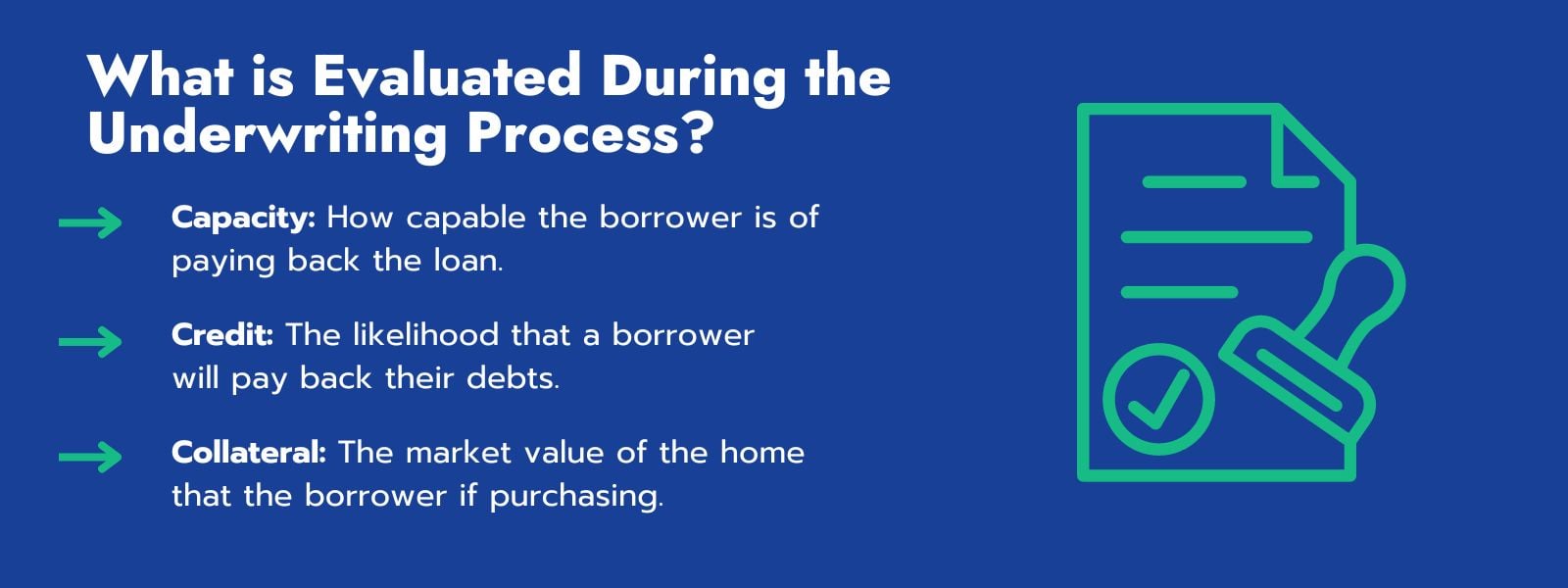

What is Evaluated During the Underwriting Process?

As we’ve mentioned, underwriters evaluate your finances, credit history, and the property you wish to purchase to determine the lender’s risk level to decide whether to approve your loan application. During the underwriting process, underwriters review three critical areas, called the 3 C’s of underwriting. These include:

Capacity

Capacity is the ability to repay a loan based on factors such as employment history, income, debt, and assets like savings and investments. Income is crucial as it indicates the amount earned monthly and its reliability. Sufficient income is necessary to cover monthly mortgage payments, and various documents are required to verify income for underwriters.

The specific documents needed depend on the type of mortgage home loan. Conventional loans typically requiring pay stubs, W2s, and tax returns. Non-QM mortgages like bank statement loans only need bank statements. Self-employed individuals or business owners may need alternative documentation like profit and loss statements and personal and business tax returns.

Underwriters aim to ensure that reported income matches actual earnings and verify employment stability, often requiring proof of at least two years in the same job or field. Self-employed individuals may need to provide additional information, such as multiple years of tax returns and business licenses.

Credit

Credit plays a crucial role in the loan approval process as it is used to assess the borrower’s reliability in repaying the loan. Lenders assess credit reports to ensure timely payments, debt settlement, and the number of open credit lines. Credit scores are significant as they indicate the borrower’s creditworthiness, with a good score reflecting a history of timely debt repayment.

Moreover, the credit report provides insight into the borrower’s debts, allowing lenders to calculate the Debt-to-Income (DTI) ratio by comparing it to their pre-tax income. While most lenders prefer a DTI below 50%, the specific requirement may vary depending on the lender and loan type. A high DTI can raise concerns for lenders as it suggests existing high debt, making it more challenging to repay a mortgage loan.

Collateral

The property itself serves as the collateral for a home loan, and underwriters verify that the home’s value aligns with the loan amount to secure it as collateral in case of missed mortgage payments.

The appraisal is essential for lenders to recoup unpaid balances in the event of default. Thus, the underwriter carefully evaluates the appraisal to determine the true value of the home and compare it to the home’s selling price. If these values do not align,the loan may be denied. For example, if a home is appraised at $375,000 but has an asking price of $450,000, it probably isn’t a wise pruchase. This would diminish the home’s suitability as collateral due to its lower value compared to the appraisal.

Steps in the Mortgage Underwriting Process

The underwriting process takes place after you’ve submitted your mortgage application. The application process varies by lender. You’ll be asked to provide various pieces of documentation and information to help the underwriter get started. To give you more insight into the mortgage approval process, here are the steps of the underwriting process:

1. Mortgage Pre-Approval

Obtaining a mortgage pre-approval is the initial step in the home-buying process. It provides insight into the likelihood of being approved for a home loan. It’s important to note that pre-approval is not the same as final approval. Being pre-approved does not guarantee approval for the actual loan or a specific amount. However, it does enhance your purchasing power and sets you apart from other buyers in a competitive market.

During the pre-approval process, the lender assesses your income, debts, and credit history. While some documentation is typically required for pre-approvals, the process is not as thorough as the actual loan application. The purpose of pre-approval is for lenders to ensure that you have sufficient income to repay the loan.

Pre-approval should take place prior to beginning your search for a home. Sellers will take buyers with mortgage pre-approval more seriously, as it’s indicative of their intent to buy a home. With mortgage pre-approval, you’ll have an indication of the likelihood of loan approval. You’ll also know the maximum amount you can borrow from that particular lender. Skipping this step is a common first-time homebuyer mistake.

2. Income & Asset Verification

In order to pre-approve you for a loan, lenders need to confirm your income and assets by examining pay stubs, tax returns, W2s, and bank statements to make sure you have enough income to cover the loan. They will also assess your liquid assets to ensure that if your income is not sufficient to cover the mortgage, you have savings that can be used. Once the lender has assessed your eligibility for a loan, they will provide you with a pre-approval letter stating the maximum amount for which you have been pre-approved.

3. Application & Appraisal

After finding your ideal home, you will need to complete a mortgage application for that property. The information you provide will determine your eligibility for a loan based on factors such as income, debt, credit history, and the appraised value of the home. This marks the beginning of the underwriting process, during which you will be required to submit various financial documents to demonstrate your ability to repay the loan. As previously mentioned, these documents may include W2s, pay stubs, tax returns, and bank statements to help underwriters verify your income. However, your Loan Officer may reach out to you if additional information is needed.

Once your underwriter has examined your documents, they will then review the home’s appraisal to confirm its true value and compare it to the purchase price. The primary goal of your lender is to ensure that the loan amount does not exceed the appraised value. In the event you default, they would need to sell the property to recover their investment. The appraisal also provides assurance to borrowers that they are not paying more for a home than its actual worth.

4. Title Search & Title Insurance

The process of title search and insurance is essential for lenders to verify that they are not providing a loan for a property that is legally owned by someone else. Ultimately, it is necessary to ensure that the property can be legally transferred to the borrower.

A mortgage underwriter or title company conducts thorough research on the property to identify any existing mortgages, claims, liens, zoning ordinances, legal disputes, unpaid taxes, or other issues that could hinder the transfer of the title to a new owner. Upon completion of the title search, the title company issues an insurance policy to guarantee the results and provide protection for both the lender and the property owner.

5. Underwriting Decision

After gathering all necessary information, the underwriter will assess the lender’s risk and make a decision regarding the approval of a loan for a specific property. They can also assist in determining the most suitable loan type for the borrower, including adjustable- or fixed-rate mortgage loans, conventional or Non-QM loans, and more.

At this stage, several outcomes are possible. Your loan may be approved, denied, placed on hold, or conditionally approved pending additional requirements. Let’s examine the implications of each of these possibilities:

- Approved: Being approved for a mortgage loan is the most favorable outcome. Once the loan is approved, you can proceed to close on the property and become a homeowner. At this stage, there is no need to provide the lender with any further information, and you can schedule a closing appointment.

- Denied: Your mortgage application may be rejected by the lender for various reasons. Often, it is due to the borrower or the property not meeting their specific loan requirements. For instance, if you have poor credit or insufficient income for the loan, the lender may deny the application. You will usually receive a specific reason for the denial to guide your next steps. For example, if the denial is due to poor credit, you will need to work on improving your credit score before reapplying. If this occurs, you may have options such as reapplying at a later time, seeking a lower loan amount, or making a larger down payment.

- Suspended or pending: Your mortgage application might be put on hold or pending if you have not provided the underwriter with sufficient information or documentation to accurately verify the details on your application. Your application can be suspended if the underwriter is unable to assess your financial situation. You can reactivate your application by providing the necessary documentation to the underwriter.

- Approved with conditions: Some approvals come with conditions. In these cases, you are technically approved but cannot proceed with closing until you provide the underwriter with additional information or documentation. This type of approval usually means that more information is required from you for the application to be fully approved. Ultimately, in these instances, you are approved, but the lender is conducting thorough checks to confirm the information they have.

How Long Does Underwriting Take?

The mortgage underwriting process can range from a few days to a few weeks, depending on factors such as the need for additional information, the lender’s workload, and the efficiency of their practices. This step is often the most time-consuming part of buying a home, contributing to the length of the closing timeline. By promptly providing required documents and information, you can help expedite the closing process.

The type of underwriting used also affects the timeline. Automated underwriting is generally faster, but may not be suitable for borrowers with unique financial situations. In such cases, manual underwriting may be more appropriate. Some lenders use a combination of both methods to assess risk.

It’s important to note that underwriting is just one aspect of the entire lending process, and it typically takes 40-50 days to complete the loan closing process.

Tips for a Smooth Mortgage Underwriting Process

1. Have Documents & Paperwork Organized

To ensure a smooth mortgage underwriting process, it’s important to have all your financial documents organized before applying for a loan. Prior to applying, aim to have the following prepared:

- Employment details from the last two years (for self-employed individuals, this includes business records and tax returns)

- W-2 forms from the previous two years

- Pay stubs from at least 30 to 60 days before applying

- Account information, such as checking, savings, money market, CDs, investment accounts, and retirement accounts

- Additional income details, including alimony, child support, annuities, bonuses, commissions, dividends, interest, overtime pay, pensions, or Social Security payments

- A gift letter if you’ve received funds from friends or relatives for your down payment

2. Improve Credit Score

Having a lower credit score may pose challenges in getting approved for a mortgage and can lead to higher interest rates on your loan. To enhance your creditworthiness, consider:

- Paying down existing debts

- Don’t apply for new loans or credit cards

- Enhancing your debt-to-income ratio (strive for < 36%)

- Reviewing your credit report and contesting any inaccuracies

3. Make a Larger Down Payment

The mortgage underwriter also takes into account the loan-to-value ratio (LTV) of your transaction: the amount of money you are borrowing, also known as the loan principal, divided by the value of the property you wish to purchase. A higher LTV ratio indicates that the lender could face greater potential losses if you default on the mortgage.

You can lower your LTV by making a larger initial down payment. The larger the down payment, the easier it may be to qualify – because you are requesting to borrow a smaller amount. Do not hesitate to seek assistance from family or friends, or explore down payment assistance programs. Check out our tips on how to find extra down payment money.

Wrapping Up Our Guide to The Mortgage Underwriting Process

The mortgage underwriting process is an essential step for most homebuyers when purchasing a home.

This process allows lenders to thoroughly examine your financial situation to determine the likelihood of you repaying the loan.

Being prepared with all necessary documents and promptly responding to any lender inquiries can help expedite the underwriting process and move you into your new home more quickly.

To learn more about buying a home or if you have questions that weren’t addressed in this post, give us a call at (817) 923-7321 or contact us.

Helen Painter Group Realtors is here to offer our knowledge and expertise to help facilitate your home-buying journey.

As Fort Worth’s longest-standing and most trusted real estate agency, we’ve been serving buyers and sellers since 1958.

With over six decades of success behind us, you’ll have peace of mind knowing your best interests are being represented throughout the home-buying process.